Longer beef production cycles, lack of grazing land, and chronic disease have constrained China’s cattle production.

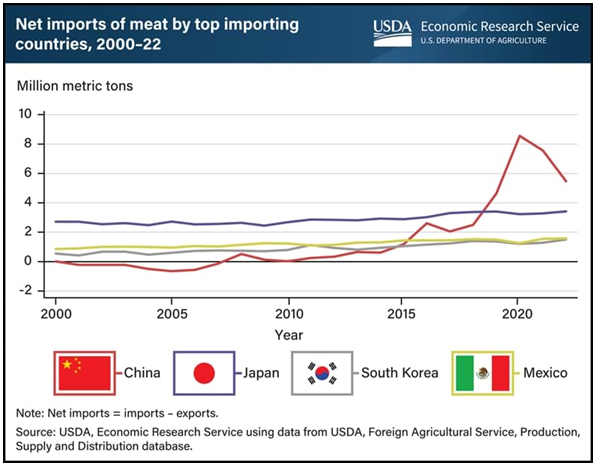

China has been the world’s largest meat importer since 2019. Despite recent reductions in imported meat volumes, the country remains in the top spot. In 2022, China imported 43 percent more than the second largest meat-importing country, Japan. Issues such as disease, tougher laws addressing environmental issues, and an exodus of small-scale farmers have constrained China’s meat supply, boosting domestic prices and incentives to import. As China’s most consumed meat, pork tends to dominate its meat supply and demand. China surpassed Japan to become the top meat importer after an African swine fever epidemic sharply reduced China’s pork supply in 2019. Pork output rebounded and meat imports dropped, but China remained the top meat importer in 2022.

Meanwhile, beef imports have been on the rise. Longer beef production cycles, lack of grazing land, and chronic disease have constrained China’s cattle production, preventing it from meeting domestic demand. Poultry consumption also is rising, as chicken tends to be the least expensive meat for consumers to purchase, but rising feed costs and disease have increased domestic prices and boosted poultry imports. China’s meat consumption showed signs of peaking after 2014, but statistical model projections show that consumption will continue to grow through 2031 based on trends such as dietary change and moderate growth in Chinese income and prices. In the short term, the Coronavirus (COVID-19) pandemic and resulting economic slowdown in China weakened consumption and associated import prospects during 2022. In addition, factors such as ongoing disease risks and high feed costs—which reduce profitability for China’s livestock producers—continue to play a role in the market.