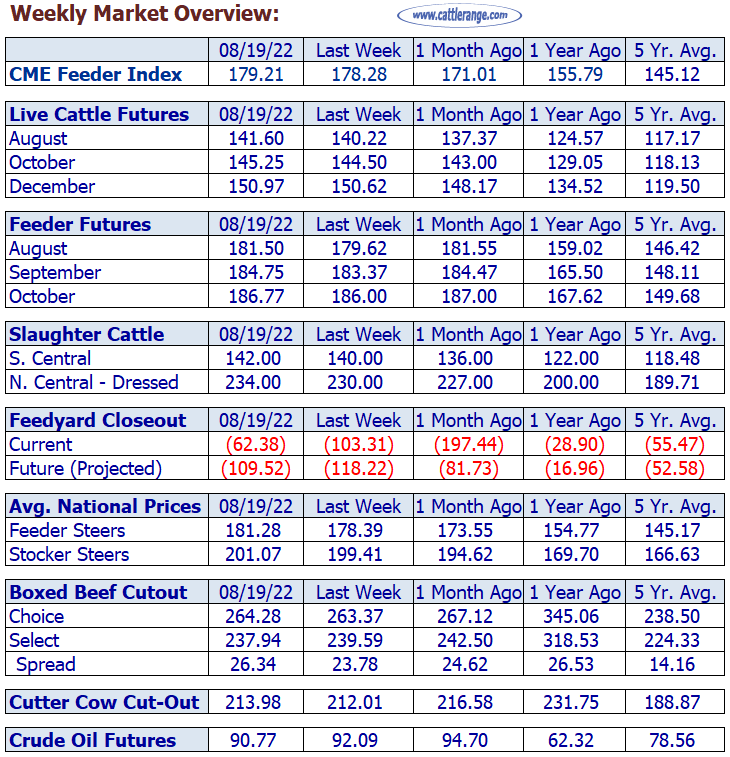

For the week, slaughter cattle trade was 2.00 to 4.00 higher with feeder cattle and stocker calves 3.00 to 1.50 higher, respectively. Live Cattle & Feeder Cattle Futures were higher while dressed beef cutouts were mixed and corn lower.

Cattle/Beef Complex Indexes...

Indexes track the daily market values for the past 10 & 60 days. Each daily value is the weighted total of the Gain/(Loss) for 15 market factors compared to the previous trading day.

10-Day Index Trendline

Change from Previous Day: -0.53%

Change from 10 Days Ago: +1.10%

60-Day Index Trendline

Change from 60 Days Ago: +12.83%

Change from 60 Day High: -1.45%

Slaughter Cattle: Trade in the South was 2.00 higher at 142.00 with Northern dressed trade 4.00 higher at 234.00. In the 3 front months, Live Cattle futures closed from 0.35 to 1.38 higher. USDA’s most recent carcass weight data showed weights averaged 892 lbs., 2 lbs. lighter than last week and 4 lbs. lighter than last year.

Feeder Cattle: The national average price for feeder steers @ 181.28, 2.89 higher with trade steady to 5.00 higher. In the 3 front months, Feeder Cattle futures closed from 0.77 to 1.88 higher.

Stocker Calves: The national average price for stocker steers @ 201.07, 1.65 higher with trade mostly 1.00 to 3.00 higher.

CME Feeder Cattle Index: 179.21, 0.93 higher than last week.

Boxed Beef Cutouts: Choice cutout 0.91 higher at 264.28 higher and the Select cutout 1.65 lower at 237.94. The Choice/Select spread at 26.34, 2.56 higher.

Cutter Cow Cutout: 1.97 higher at 213.98.

Slaughter Cows: Trade 2.00 lower to 4.00 higher.

Total red meat production under Federal inspection for the week ending Saturday, August 20, 2022 was estimated at 1043.4 million lbs. according to USDA’s Marketing Service. This was 2.4 percent higher than a week ago and 1.4 percent lower than a year ago. Cumulative meat production for the year to date was 1 percent lower compared to the previous year.

Grain: Corn was 0.03 lower @ 7.31 with December futures @ 6.2325, 0.1900 lower. Wheat 0.53 lower @ 7.89 and the futures @ 7.7100, down 0.5150.

-

View Complete Summary • • Printable Version • • Archive

-

Subscribe to receive via e-mail Saturday mornings around 7:00 AM