Derrell S. Peel, Oklahoma State University

The Cattle report released by USDA in late January does nothing to change the strong fundamentals driving cattle markets. Nearly all inventory categories were down year over year, including the all cattle and calves total, down 0.4 percent compared to last year. The 2025 calf crop was smaller than earlier projections at 32.9 million head, the smallest since 1941.

Of most significance, and slightly surprising, the beef cow herd decreased another 1.0 percent year over year as of January 1, 2026. The beef cow inventory now stands at 27.61 million head, the smallest since 1961. Since the cyclical peak in 2019, at 31.64 million, the beef cow herd has decreased 4.03 million, a total seven-year drop of 12.7 percent. The 2026 low extends the current cattle cycle to 12 years since the previous low in 2014. Although this is likely to be the cyclical low, it will not be confirmed until next year. The July cattle report may provide additional guidance.

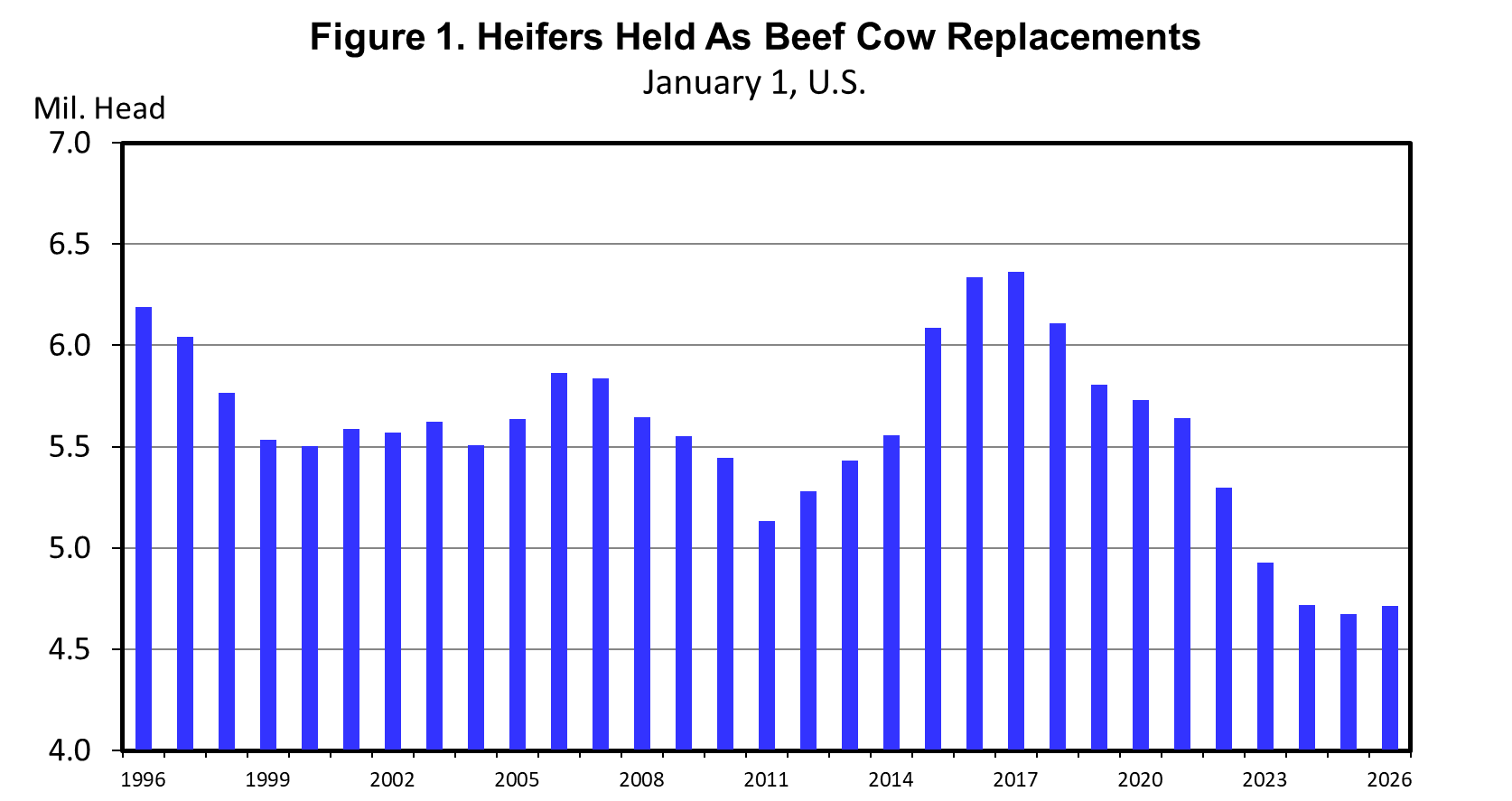

The inventory of beef replacement heifers was up slightly, by 0.9 percent year over year. The is the first increase in beef replacement heifers in nine years, since the previous peak in 2017 (See Figure 1 above). The tiny increase in beef replacement heifers is consistent with recent indications of a minor amount of heifer retention but is not enough to signal any beef cow herd growth. If anything, it indicates stabilization of the herd at current levels in anticipation of potential future growth.

All categories of feeder cattle were down year over year including steers >500 pounds, down 0.6 percent; other heifers >500 pounds, down 1.5 percent; and calves <500 pounds, down 0.1 percent. However, total feedlot inventories were down 3.3 percent year over year. Thus, the calculated supply of feeder cattle outside of feedlots on January 1 was up 0.9 percent. This does not mean there are more feeder cattle in the country but simply that a few more of the smaller supply from last year has yet to be placed in feedlots.

Little, if any, beef cow herd growth is possible in 2026. It will depend on beef cow slaughter and herd culling. Beef cow slaughter decreased 40.5 percent in three years from 2022-2025, leading to a net culling rate of 8.4 percent in 2025. This low culling rate means that older cows will need to be culled going forward. Beef cow slaughter is expected to stabilize or perhaps increase some in 2026. That means that the slight increase in beef replacement heifers will be needed just to maintain the current herd or, at most, increase fractionally in 2026.

Once again, the industry is waiting for indications of significant beef heifer retention that would indicate potential beef herd growth. Tight cattle supplies will continue to support cattle prices, likely pushing prices higher. When increased heifer retention occurs, supplies will tighten further, pushing prices even higher. This, of course, is predicated on continued strong beef demand, which shows no sign of weakening at this point.