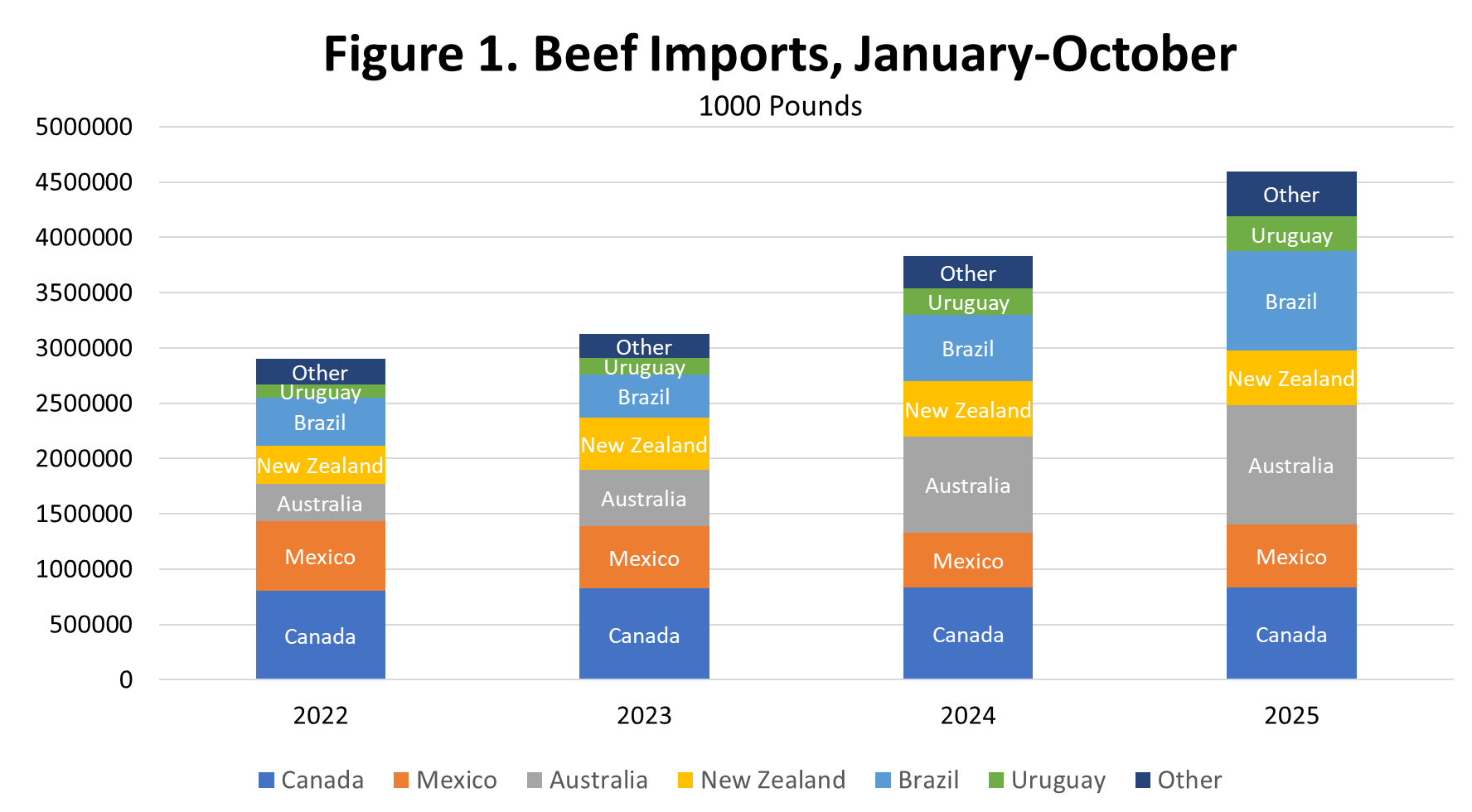

For the first ten months of 2025, beef imports were up 20.0 percent year over year (Figure 1). This follows a 24.4 percent year over year increase in 2024.

Derrell S. Peel, Oklahoma State University

The latest release of shutdown-delayed trade data provides information on beef and cattle imports and exports through October 2025. Beef imports have been a particular focus in industry and politically for several months.

For the first ten months of 2025, beef imports were up 20.0 percent year over year (Figure 1). This follows a 24.4 percent year over year increase in 2024. Increased beef imports are the expected market response to declining beef production in the U.S., especially decreased production of nonfed processing beef. Through 2025, U.S. cow slaughter is projected to be down a total of 29.2 percent from the recent peak in 2022. Beef imports have increased to partially mitigate the resulting decreases in lean processing.

Through October, Australia was the largest source of U.S. beef imports with a 23.6 percent share of total imports. Number two Brazil accounted for 19.5 percent of beef imports, followed by Canada (18.2 percent share), Mexico (12.3 percent share), New Zealand (10.8 percent share), and Uruguay (6.8 percent share). Despite much political focus on Argentina in the fourth quarter of 2025, Argentina only represents about 25 percent of the “Other” category in Figure 1, representing 2.2 percent of total beef imports.

Figures 1 and 2 shows the dramatic increase in beef imports from both Australia and Brazil since 2022. Figure 2 also illustrates the dramatic difference in the seasonal pattern of beef imports from the two countries. Beef imports from Brazil are included in the “Other Country” quota. Since 2022, Brazil has moved quickly in January of each year to fill the “Other Country” quota before being subject to over-quota tariffs. The January spikes in imports of Brazilian beef are obvious in Figure 2. In 2025, a second peak in beef imports from Brazil occurred in May as market values stimulated additional imports despite the over-quota tariffs and additional 10 percent tariffs imposed in April. However, an additional 40 percent tariff imposed on Brazil in August did result in sharply lower imports from Brazil in September and October. By the end of November, all the of the additional tariffs have been removed leaving Brazil with only the over-quota tariff (26.5 percent) for the remainder of the year.

So far in January 2026, Brazil is moving quickly to fill the “Other Country” quota in the first two weeks of the year with zero tariff. Subsequent imports from Brazil going forward will be subject to the over-quota tariff. Once again, data will eventually confirm a spike in total beef imports in January as a result. Despite this, the domestic price of 90 percent lean trimmings in the first full week of January was $401.71/cwt., up 19.8 percent from the same period one year ago.