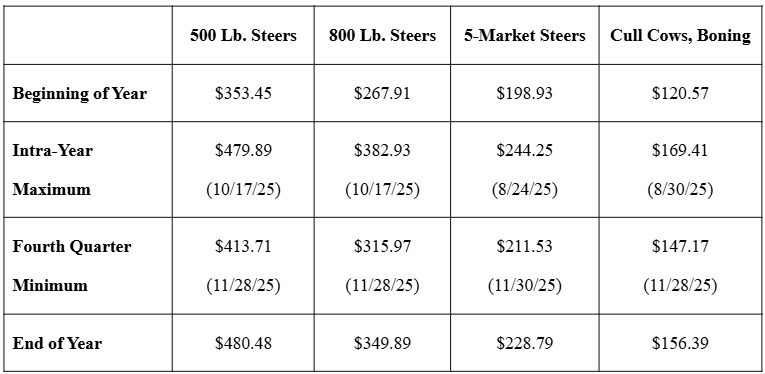

Table 1. 2025 Oklahoma Auction and 5-Market Fed Cattle Prices, Weekly, $/cwt.

Derrell S. Peel, Oklahoma State University

Cattle prices advanced for a third consecutive year in 2025. Prices for all classes of cattle moved higher, setting frequent records for most of the first three quarters of the year before experiencing a sharp correction in the fourth quarter. Cattle prices recovered in December to end the year and set the stage for markets in 2026. Table 1 summarizes 2025 prices for calves, feeders, fed cattle and cull cows.

Oklahoma auction prices for 500-pound steer calves picked up from year-end highs in 2024 and increased even more sharply in 2025. Prices started the year at $353.45/cwt. and ended at $480.48/cwt., a 35.9 percent increase for the year. By the end of December, these calf prices had fully recovered from the fourth quarter correction, when prices that were at $479.89/cwt. by mid-October dropped to $413.71/cwt. at the end of November, a 13.7 percent drop, before recovering to a new high in December.

Prices for 800-pound feeder steers at Oklahoma auctions began 2025 at $267.91/cwt. and ended with a December price of $349.89/cwt., a net increase of 30.6 percent for the year. Feeder prices peaked earlier in mid-October at $382.93/cwt., dropping to a late November low of $315.97/cwt. before partially recovering in December. The correction from October through November was 17.5 percent and the recovery in December left prices down 8.6 percent from the October high.

Fed cattle price started 2025 at $198.93/cwt., peaked at $244.25/cwt in August and ended the year at $228.79/cwt., a net increase of 15.0 percent for the year. The 5-market price drifted slightly lower from the summer peak through the third quarter before correcting down to $211.53/cwt. in late November. The fourth quarter correction was a drop by 13.4 percent to the November low. Fed prices then recovered to finish the year and, by the end of the year, fed prices were down 6.3 percent from the August peak.

Cull cow prices rose from $120.57/cwt in January to a late August peak of $169.41/cwt before finishing the year at $156.39/cwt. From the beginning to the end of the year, cull cow prices increased 29.7 percent. Cull cow prices were also subject to the fourth quarter correction, dropping to a late November low of $147.17 before recovering in December. Prices dropped 13.1 percent from the summer high to late November but by the end of the year were down just 7.7 percent from the August peak.

What to expect in 2026

Higher Feeder and Fed Cattle Prices

Seven years of declining calf crops, culminating in the 2025 calf crop at the lowest level since 1941, and limited signs of heifer retention mean the feeder cattle supplies will be tighter going into 2026 and may tighten even more during the year if heifer retention picks up.

Prices Advancing More Slowly

Feeder and fed cattle prices, though expected to increase, are likely to increase relatively less in 2026 compared to 2025. In 2025, feeder cattle prices increased roughly 25-35 percent while fed cattle prices increased 15-20 percent. Both feeder and fed prices are likely to see prices increase in the range of 5-15 percent in 2026.

Continued Volatility

Unfortunately, volatility is likely to continue to be a risk for cattle producers. The big fourth quarter 2025 correction should remove the tendency for a market or technical correction for quite some time, but external sources of uncertainty are likely to continue injecting volatility into cattle markets going forward. With cattle and beef markets continuing to be a focus of political scrutiny, markets are subject to additional political rhetoric and meddling.