Derrell S. Peel, Oklahoma State University

High cattle and beef prices are suddenly receiving intense scrutiny from politicians, consumers and the media. While it seems to many that the situation has only recently happened, it has, in fact, been developing for several years. The beef cow herd on January 1, 2025 was 27.86 million head, down 3.78 million head, or 11.9 percent, from the cyclical peak of 31.64 million head in 2019. The beef cow herd is currently the smallest inventory since 1961. The projected 2025 calf crop is 33.1 million head after declining for seven consecutive years and is the smallest since 1941.

What began as modest cyclical herd liquidation in 2020, accelerated and extended from 2021 through 2024 as a result of widespread, roving drought that impacted most of the beef cattle production across the country. Lack of forage and adverse production conditions forced producers to reduce herds, significantly more than intended.

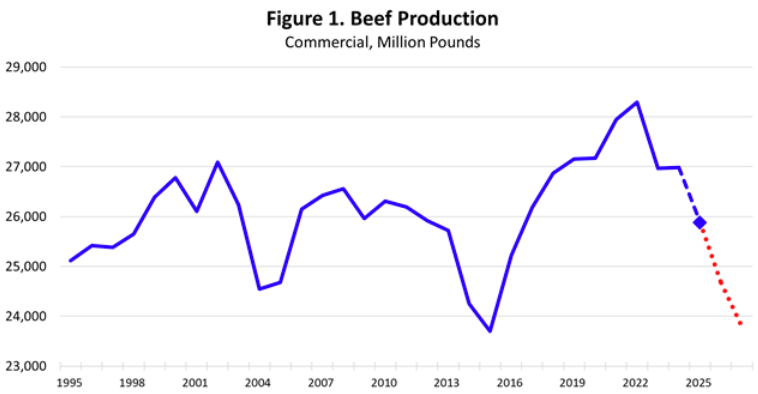

The beef cattle industry is complex and unique among livestock industries. Cattle are slow-growing animals that reproduce one at a time. One feature that is particularly important is that breeding cattle and cattle used for beef production originate from the same set of animals. This means that herd liquidation temporarily increases cattle slaughter and beef production. As the beef cow herd decreased after 2019, increased cow and heifer slaughter pushed beef production to record levels in 2022 (Figure 1 above, blue dashed line projection for 2025). Consumers – and politicians – enjoyed ample supplies of relatively inexpensive beef, oblivious to the fact that it meant that future beef production would inevitably decrease.

Beef production is now decreasing, pushing retail beef prices to record levels. Without herd rebuilding, beef production will remain low due to limited cattle numbers. Herd rebuilding is expected – at some point – which will lead to further reductions in beef production. The opposite of herd liquidation means that heifer retention for breeding will make a tight cattle supply even tighter as heifers currently used for beef production are retained for breeding and future beef production – leading to additional reductions in beef production in the meantime (Figure 1, red dotted line forecasts). There is no way (or any policy!) to change the fact that beef supplies will be tight – and get even tighter – over the next two to four years before beef production can be increased.

The current high cattle and beef prices developed over several years and at a high cost. Producers have been subjected to detrimental physical, emotional and financial tolls that affect operations for years. Cattle ranchers were forced to sell productive breeding animals prematurely, with most going to slaughter. Producers attempting to manage through the drought incurred increased production costs, including record high prices for hay – only to be finally forced to sell animals in many instances. Physical recovery of ranges/pastures and the financial recovery of ranches is a slow process. Producers are now enjoying high cattle prices and record returns per head, but low inventories mean that cattle ranches are selling fewer animals and still face high overhead costs to maintain pastures, fences, equipment and production facilities. High cattle prices for a period of time are necessary to allow cattle ranches to recover, rebuild, and prepare for the next cattle cycle.

That is the true source – and cost – of high cattle and beef prices.