The current boxed beef value is 31.7 percent higher than one year ago.

Derrell S. Peel, Oklahoma State University

The USDA Choice boxed beef cutout was $404.77/cwt. last week, down from the year-to-date peak of $413.60/cwt. in the first week of September. The current boxed beef value is 31.7 percent higher than one year ago, with all primal values higher year over year. Rib primals are up 31.5 percent; loin primals, up 31.4 percent; round primals are 31.5 percent higher; and chuck primals are up 34.6 percent from last year. Brisket, short plate and flank primals are also up 21 to 35 percent year over year. Across forty wholesale cuts reported by USDA, twenty products are up more than 20 percent year over year and the average increase across all forty is 32.8 percent over last year. The only product down from one year ago is short ribs, which are almost exclusively an export product and weak due to decreased beef exports.

Prices for 90 percent lean trimmings were $434.05/cwt. last week, down slightly from the previous weekly high of $435.31/cwt. and up 17.1 percent year over year. Fifty percent lean trimmings are priced at $159.89/cwt., up 30.9 percent from last year. A 7:1 ratio of 90s to 50s makes an 85 percent lean mix with a price of $399.78/cwt. for wholesale ground beef value, up 17.7 percent from one year ago.

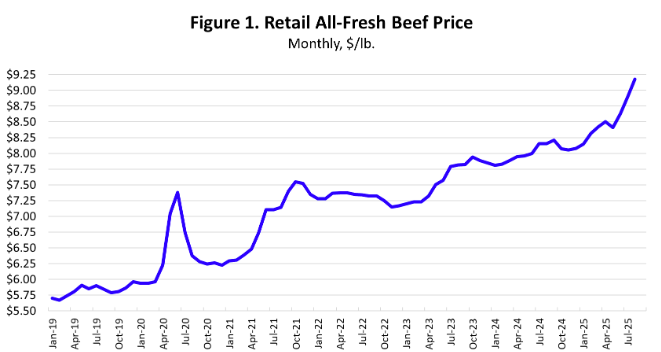

USDA recently released the August retail meat prices showing that the all-fresh beef price was another record high at $9.18/lb., up from last month and up 12.6 percent year over year – over $1/lb. higher than one year ago (Figure 1). Retail pork prices dropped slightly from last month and are up 2.2 percent from last year, while retail broiler prices were fractionally higher this month and up 1.9 percent year over year.

Retail beef prices continue to increase relative to broiler and pork prices. Figure 2 shows the beef-to-broiler and beef-to-pork retail price ratios since January 2023. The ratios have continued to increase and are at record levels in August 2025, with a ratio of 3.69 for beef-to-broiler prices and 1.83 for beef-to-pork. The beef-to-broiler ratio has increased 10.5 percent in the past year and is up 24.3 percent since January 2023. The beef-to-pork ratio has increased 10.2 percent year over year and 22.0 percent since January 2023.

Beef prices remain strong and beef demand is robust despite the availability of favorably priced alternative proteins. Moving into the fall, consumer demand shifts from a summer grilling focus to crock pot cooking and increased restaurant visits. This may slightly change relative values among beef products, but beef product demand continues strong at all levels.