Derrell S. Peel, Oklahoma State University

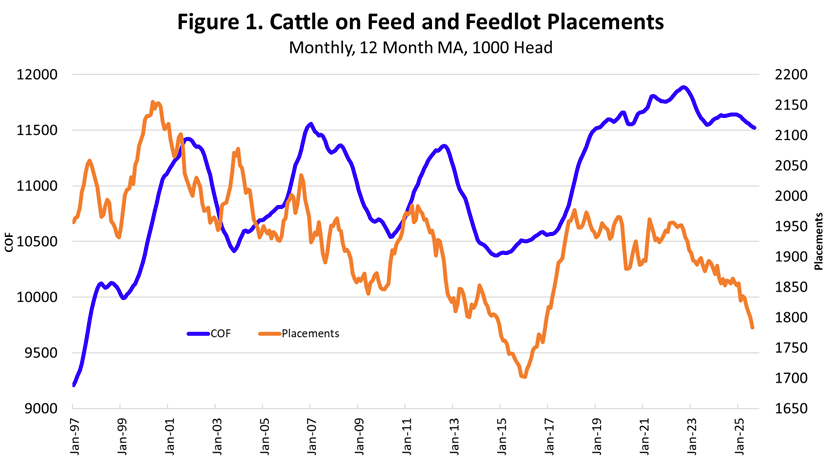

The September 1 feedlot total was 11.08 million head, down 1.1 percent year over year and the tenth consecutive monthly decrease compared to one year earlier. Feedlot inventories continue to decline slowly. Average inventories the past year are down just 3.1 percent from the peak in 2022, but the September 12-month moving average is at the lowest level since January 2019. With the September on-feed total up slightly from the previous month, the August total was likely the seasonal low for the year. The feedlot inventory on August 1 this year was the lowest monthly inventory since October 2017.

Total feedlot production is declining more rapidly than the slowly declining feedlot inventories would indicate. Feedlot placements in August were 90.1 percent of last year and the smallest August placement total since 2015. Figure 1 above shows the relative comparison between 12-month moving averages of cattle on-feed and feedlot placements. Placements have declined more than the on-feed inventory up to this point aided by a slower turnover rate in feedlots.

August marketings were down 13.6 percent compared to last year. Feedlot marketings for the first eight months of 2025 are down 5.4 percent year over year. Average feedlot marketings the past year are down 8.2 percent from peak average marketings in 2022. Smaller calf crops and limited feeder cattle supplies mean there is less cattle available for feedlot production. Feedlot production and beef production are expected to continue to decline into 2027.