Derrell S. Peel, Oklahoma State University

The July Cattle on Feed (COF) report showed the continued decrease in feedlot inventories. Feedlot placements in June were down 7.9 percent year over year, more than expected. June feedlot marketings were down 4.4 percent year over year, in line with pre-report expectations.

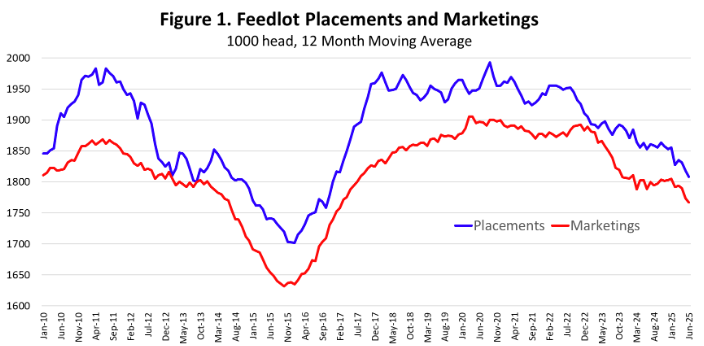

Over the past six months, total placements were 5.0 percent less than one year earlier while total marketings were down 4.0 percent year over year. Placements decreased by 539 thousand head and marketings decreased by 437 thousand head in the past six months. The difference means that placements decreased by 102 thousand head more than marketings thereby reducing feedlot inventories. Average placements and marketings have generally been falling for roughly five years, at a faster rate recently (Figure 1). Decreased flow of cattle through feedlots corresponds to the decline in total calf crop since the cyclical peak in 2018.

The July 1 feedlot inventory was 11.124 million head, down 1.6 percent year over year. This is the eighth consecutive month of year-over-year decreases in feedlot numbers. The 12-month moving average of feedlot inventories has now dropped to the lowest level since May 2019. However, the current level is just 2.9 percent below the peak level in September 2022, indicating that feedlot inventories have declined slowly compared to the calf crop.. The estimated 2025 calf crop is 33.1 million head, 8.8 percent lower than the cyclical peak in 2018. The estimated supply of feeder cattle outside of feedlots in the July Cattle report is the smallest in 29 years of available data.

The July COF report also included the quarterly breakdown of steers and heifers in feedlots.

Heifers in feedlots decreased by 5.4 percent from last year. However, heifers, as a percentage of total feedlot inventories, was 38.1 percent, up from the April 1 level of 37.6 percent. The number of heifers in feedlots would indicate that heifer retention is not underway to a significant level.

The July Cattle report provided a mid-year look at cattle inventories. The report is tricky to interpret since there was no report last year for comparison. The report showed total cattle inventories at 94.2 million head, down 1.3 percent from the 2023 level. Most report categories were down in the two-year comparison as the industry was clearly liquidating through 2024.

The beef cow inventory was reported at 28.65 million head, down 1.5 percent from 2023 but up 2.8 percent compared to the January 1 level. Historically, this would indicate some herd growth in the first half of the year but there is little other data to corroborate this estimate. Beef replacement heifers for July 1 were 3.7 million head, down 5.1 percent from two years ago. The comparison of July to January beef replacement heifers was about the same as two years ago and does not indicate heifer retention. From the other inventory categories, the estimated supply of feeder cattle outside feedlots is 34.0 million head, the lowest in 29 years of available data.

Taken together, the July Cattle on Feed and the Cattle reports do not indicate significant heifer retention. My feeling is that some movement towards herd rebuilding may be starting but is very slow and cautious. It is possible, perhaps even likely, that the January 2025 beef cow herd will be the cyclical low, but the January 2026 inventory will likely be close to unchanged showing very little, if any, growth this year.