Derrell S. Peel, Oklahoma State University

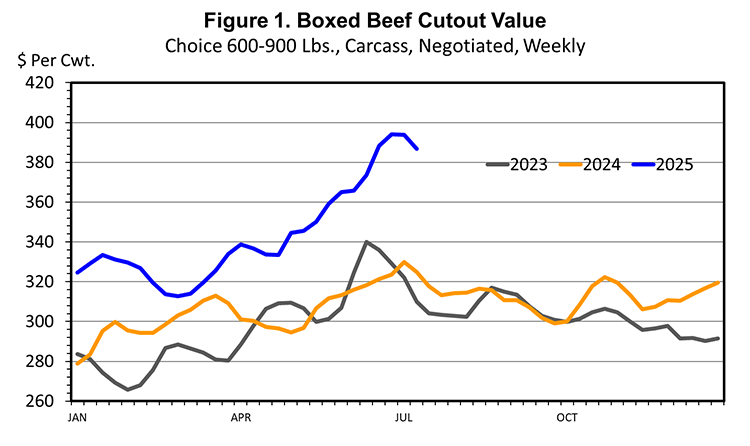

The summer doldrums between Independence Day and Labor Day usually means slack beef demand. Indeed, the Choice boxed beef cutout dropped from the end of June to a current weekly average of $386.75/cwt., down from the recent high of $394.19/cwt. However, boxed beef prices remain 19.1 percent above this time last year and have averaged 12.6 percent above one year ago each week in the first half of the year.

Higher average boxed beef prices reflect generally strong beef demand coupled with declining beef production, especially in the second quarter of the year. Total beef production is down 1.7 percent year over year through the first half of the year but is down 4.8 percent in the second quarter. Fed (steer + heifer) slaughter was down 6.3 percent in the second quarter leading to a 4.1 percent year-over-year decrease in fed beef production. Total cow slaughter continued lower, down 11.0 percent in Q2 leading to an 8.5 percent drop in nonfed beef production for the period.

Despite typical mid-summer seasonal weakness, all beef primals are priced above year ago levels with the Rib primal up 7.0 percent, Loin primal up 19.3 percent; Chuck primal up 20.2 percent and the Round primal up 16.4 percent year over year. Brisket, Short Plate and Flank primals are also sharply higher year over year. Prices for both lean and fatty trimmings continue to push higher with declining beef production.

Cattle prices dropped in late June but bounced this past week on stronger Feeder and Live cattle futures. Oklahoma auction feeder prices were higher for all weights with calves up $10-$15/cwt. and feeder cattle up $5-$15/cwt. The 5-market fed cattle price averaged over $235/cwt., pushing up close to the mid-June highs. Boning cows (average dressing) averaged $165.84/cwt.

Articles on The Cattle Range are published because of interesting content but don't necessarily reflect the views of The Cattle Range.