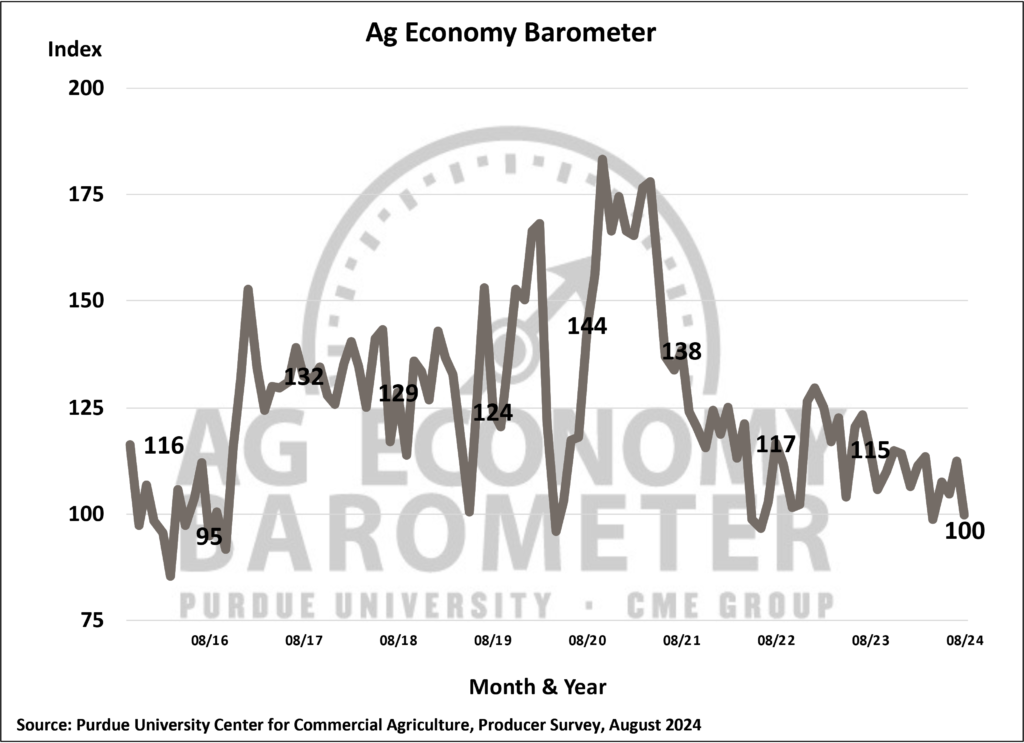

In a sharp turnaround from July, farmer sentiment nose-dived in August. The August Purdue University-CME Group Ag Economy Barometer fell 13 points vs. July, leaving the index at 100, while the Index of Current Conditions fell 17 points to 83, and the Index of Futures Expectations shed 11 points to a reading of 108. Weakening farm income prospects weighed on farmer sentiment as the outlook for a bountiful fall harvest were more than offset by declining crop prices.

This month’s decline in the barometer takes farmer sentiment back to the average level observed from fall 2015 to winter 2016, a period when farm incomes were declining sharply. The weakness in farmer sentiment could indicate that farmers expect this year’s farm income downturn to last for an extended period. Data collection for the August survey took place from August 12-16, 2024.

The August reading of 100 places farmer sentiment on par with sentiment in late 2015 and early 2016 when the U.S. ag economy was in the early stages of a downturn. Farmers were most pessimistic about near-term conditions, as the current index fell 17 points below a month earlier. Sentiment weakness was driven by expectations for weak farm financial performance and extended to a weak outlook for capital expenditures by farm operations. Although the short-term farmland index remained above 100, signaling that more survey respondents still expect values to rise over the next year than look for values to decline, it’s clear that farmers are less optimistic about farmland values this summer than in recent years. Notably, the short-term farmland index posted its lowest reading since spring 2020. Despite the weakness in farmer sentiment and expectations for weak farm financial performance, 70% of crop farmers in this month’s survey said they expect farmland cash rental rates to remain about the same in 2025 as in 2024.