Derrell S. Peel, Oklahoma State University

The biggest question in the cattle industry continues to be that of herd rebuilding. Specifically, there are questions regarding the status of the beef cow herd in 2024 and, more importantly, how is the industry setting up for 2025 and beyond. Beef herd expansion involves two components: reduced cow culling and increased heifer retention. Direct measures of the cow herd inventory and replacement heifer inventories are only available in the January 1 USDA-NASS Cattle report, with the next release in late January 2025. In the meantime, it is challenging to determine what is happening in 2024.

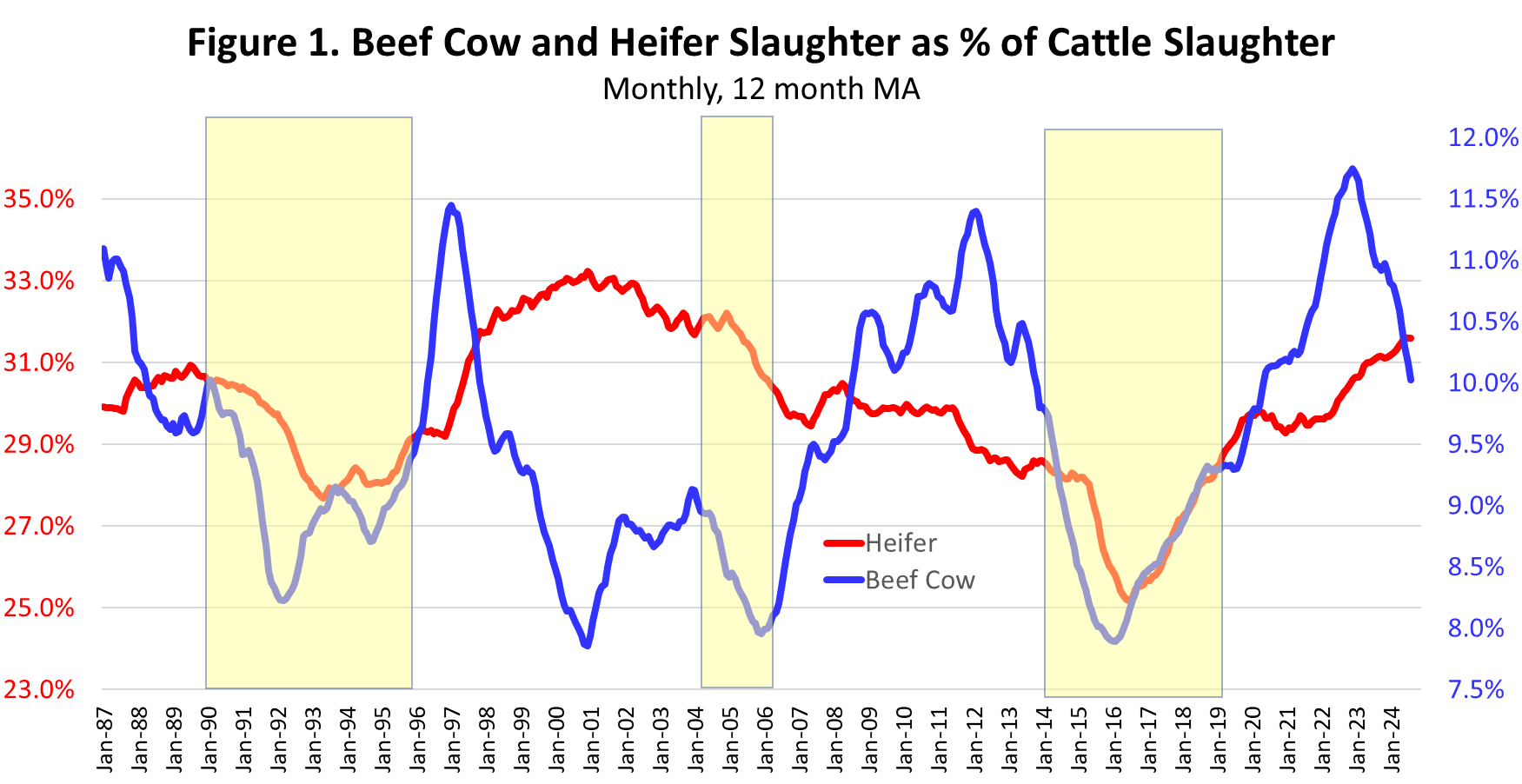

There is data on beef cow slaughter through the year that does indicate the beef cow herd culling rate. The final rate is usually expressed annually as total annual beef cow slaughter as percent of the January 1 beef cow inventory. The annual beef cow slaughter total will not be available until after the end of the year. In the first 37 weeks of 2024, beef cow slaughter is down 16.3 percent year over year. Monthly beef cow slaughter can be expressed as a percentage of total cattle slaughter. On an annual basis, beef cow slaughter as a percent of total cattle slaughter is 97.5 percent correlated with the annual herd culling rate. A twelve-month moving average of this percentage provides an indication during the year of beef cow herd culling. The blue line in Figure 1 above shows this moving average since 1987. The two major cyclical beef herd expansion in the 1990-1996 and 2014-2019 periods shows how beef cow herd slaughter behaves during herd expansion.

In the two previous herd rebuilds, beef cow slaughter bottomed in 1992 and in 2016. The moving average reflects the previous twelve months suggesting that beef cow slaughter was at a low in the first year of herd expansion in each of these cycles. Figure 1 indicates that beef cow slaughter is declining currently but has not bottomed and is not yet low enough to indicate herd expansion. Moreover, the rate of beef cow slaughter in 2024, although sharply lower year over year, is not down enough to offset the small bred beef heifer inventory at the beginning of the year. The beef cow herd is likely down year over year in 2024.

Figure 1 also contains a similar twelve-month moving average of heifer slaughter as a percentage of total cattle slaughter. Heifer slaughter goes down when heifer retention increases and there is a 72.5 percent correlation (negative) between this slaughter percentage and beef replacement heifer percentage (beef replacement heifers as a percent the beef cow herd inventory). The correlation is strong but less than for cows because heifer slaughter includes more than just beef heifers.

Figure 1 shows that the moving average of heifer slaughter also bottoms during herd expansion, typically about a year later than the cow slaughter moving average. In 2024, the twelve-month moving average of the heifer slaughter percentage of total cattle slaughter has not decreased at all thus far. Both of the measures in Figure 1 suggest that there is only minimal indication of industry movement towards herd rebuilding. The beef cow herd will likely be smaller on January 1, 2025 and has very limited potential to do anything other than stabilize and hold steady in 2025.