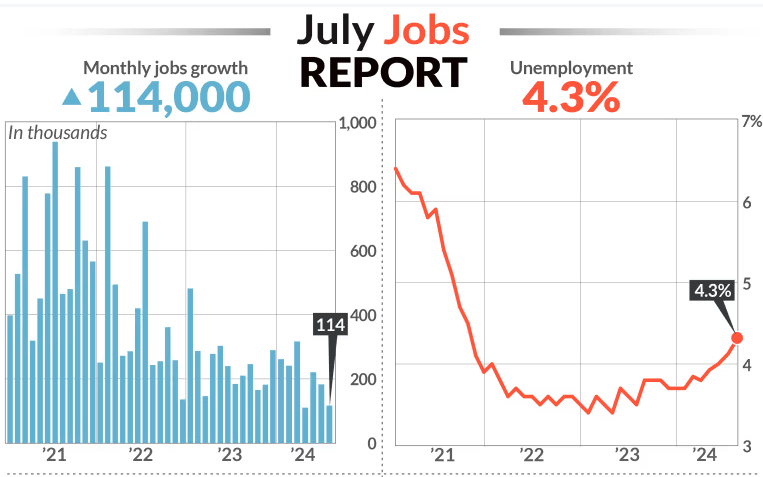

The U.S. created a tepid 114,000 new jobs in July and signaled a slowdown in hiring since the spring, as the weight of high interest rates pressed down on the economy.

The meager increase in jobs last month is the latest evidence of a gradual erosion in arguably what was the strongest labor market ever. It could also be a sign of a deterioration in the economy.

A softening labor market and slowing inflation are laying the groundwork for the Federal Reserve to cut high U.S. interest rates by September.

The Fed jacked up rates in 2022 and 2023 to a 23-year-high to try to tame high inflation, but high borrowing costs have also depressed economic growth.

Unemployment, meanwhile, rose to 4.3% from 4.1% and hit the highest level since October 2021. The jobless rate has risen steadily from an extremely low 3.4% about one and half years ago.

Wages rose a mild 0.2% last month. The increase in pay over the past year slowed to 3.6% from 3.8% in the prior month and is returning close to prepandemic levels.

Pay had soared after the pandemic when businesses were scrambling to hire workers during an acute labor shortage. Now wage growth is slowing as the demand for labor dries up.

Fed Chairman Jerome Powell on Wednesday said the labor market has not been a significant source of inflation.