Derrell S. Peel, Oklahoma State University

Coming into 2024, the beef cow herd is at a 63-year low – the smallest beef cow inventory since 1961. This has pushed cattle prices to record levels through 2023 and 2024. And yet, there are no indications that any beef herd rebuilding is underway. The question of rebuilding the beef cow inventory is fundamental for cattle markets in the next few years.

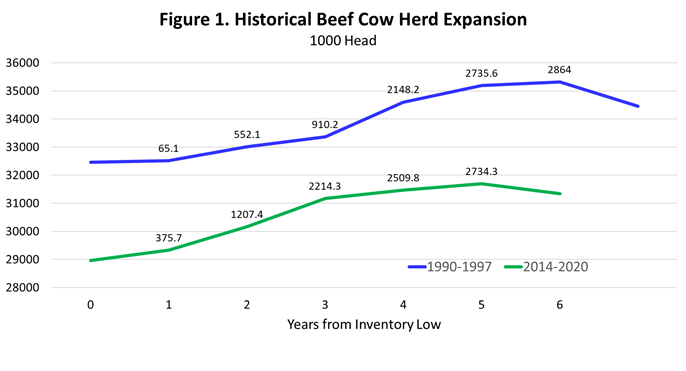

A review of historical herd expansions is instructive. Figure 1 shows the path of beef cow herd increase for the past two complete cyclical expansions. From 1990-1996, the beef cow herd increased by 2.864 million head. From 2014-2014, the beef cow herd increased less – by 2.734 million head – in one less year but faster. The beef cow herd increased by 1.2 million in just two years from 2014-2016.

One of the keys to herd expansion is heifer retention. Figure 2 shows the changes in beef replacement heifer inventories leading to and during herd expansion. Beef replacement inventories increased three of four years prior to the beginning of herd expansion in 1991 and for three years prior to herd expansion in 2015. Both expansions included one year of very large heifer retention (year 3 in 1993 and year 2 in 2015) with smaller increases before and after.

History provides some insight into what to expect in the next few years. First, is the fact we do not yet have a zero year (low inventory) from which herd rebuilding can begin. Beef cow slaughter is sharply lower, down nearly 16 percent year over year thus far in 2024. However, that level of beef cow slaughter, combined with the low beef replacement heifer inventory in 2024 (Figure 3) implies that the beef cow herd continues to liquidate by another 0.5 – 1.0 percent in 2024. Beef cow slaughter would have to drop by roughly 22 percent year over year to avoid additional liquidation this year. The current rate of beef cow slaughter indicates a herd culling rate in excess of 10 percent this year. The culling rate is expected to drop below 10 percent during herd expansion. Thus, 2025 is the earliest zero year for the next expansion to begin. There is no certainty that additional liquidation will not occur in 2025.

Figure 3 shows the level of beef replacement heifer inventories since the cyclical peak in 2017. Liquidation of beef replacement heifer inventories in recent years means that there is no pipeline or momentum for herd expansion compared to previous expansions. Moreover, the level of heifer slaughter and heifers in feedlots in 2024 suggests that the replacement heifer inventory in 2025 is likely to show modest growth at best. Figure 3 shows a projected 2.0 percent year over year increase in beef replacement heifers in 2025. At that level, the beef cow herd is limited to stable numbers or very minimal increase in 2025. Beyond 2025, heifer retention could increase more and accelerate herd expansion beginning in 2026. Current conditions do not suggest a high likelihood of sharply accelerating heifer retention anytime soon.

The threat of continuing/redeveloping drought is one of the factors limiting the beginning of herd expansion at the current time. Should developing drought conditions become a reality in the coming months with the return of La Niña, additional herd liquidation is likely, and any herd rebuilding could be pushed off further into the future. The beef cattle industry is smaller than needed and signals for rebuilding will continue and growth in coming months. However, herd rebuilding is likely to be slow to start and proceed quite slowly initially.