Current feedlot inventories mask the continued decline in feeder cattle numbers in the U.S.

Derrell S. Peel, Oklahoma State University

The latest USDA Cattle on Feed report pegged August 1 feedlot inventories at 11.1 million head, unchanged from one year ago. Because of the strong seasonal variation in feedlot inventories, a twelve-month moving average of feedlot inventories is the best means to see the actual trend in feedlot production. The moving average total of feedlot inventories peaked cyclically in September 2022 at 11.887 million head before declining to 11.548 million head in September 2023. Total feedlot placements have decreased by 1.3 percent in the last twelve months compared to the previous twelve-month period. However, in the last year, average feedlot inventories have increased to 11.636 million head. Feedlot inventories have risen countercyclically due to continued feeding of heifers and increased days on feed. Feedlots have slowed the feedlot turnover rate enough to keep average monthly inventories higher despite fewer cattle entering feedlots.

Feedlot placements in July were 105.8 percent of last year. The placement total was slightly higher than the average trade estimate. July marketings were 107.7 percent of one year ago, close to expectations. July 2024 was unusual with two extra business days in the month, meaning that daily average feedlot marketings were actually down by 2.1 percent year over year.

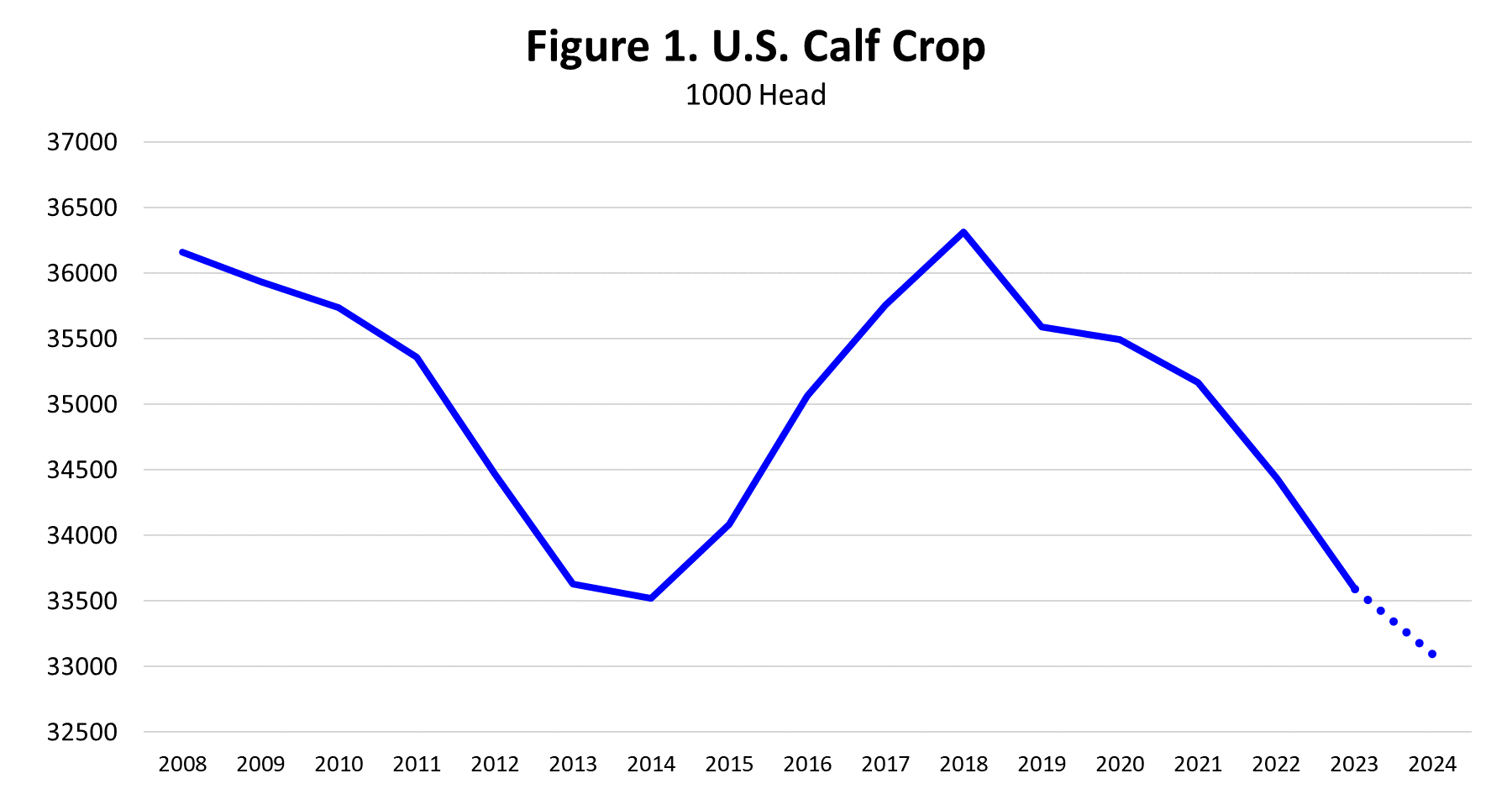

Current feedlot inventories mask the continued decline in feeder cattle in the U.S. Figure 1 shows the U.S. calf crop from 2008 to 2023 with a projected 2024 calf crop of 33.1 million head. At that level, the total calf crop is down 3.22 million head from the 2018 cyclical peak. The projected 2024 calf crop is the smallest total U.S. calf crop since about 1941 (based on estimated calf crop prior to 1960). This calf crop figure includes beef and dairy so straight-bred dairy as well as beef on dairy crossbred calves are included in this total calf crop.

In the first 32 weeks of the year, total steer and heifer slaughter was down 1.3 percent year over year, with steer slaughter down 0.9 percent and heifer slaughter down 1.9 percent compared to last year. With yearling carcass weights up sharply year over year (steers up 23.1 pounds and heifers up 18.6 pounds), fed beef production for the year to date is up 1.1 percent over last year. By contrast, nonfed beef production is down 13.0 percent thus far in 2024 led by a total cow slaughter decrease of 15.3 percent year over year. Beef cow slaughter is down 15.9 percent and dairy cow slaughter is down 14.6 percent year over year, along with a 7.4 percent year over year decrease in bull slaughter. Cow carcass weights are up 10.7 pounds year over year and bull carcass weights are up 28.8 pounds year over year. Total beef production is down 1.4 percent thus far in 2024 compared to last year. At the current rate, total beef production for the year may be down two percent or less from last year, substantially less than earlier expectations of a four to five percent year over year decrease in beef production.

Derrell Peel, OSU Extension livestock marketing specialist, explains why heifer retention could tighten up the market on SunUpTV from August 24, 2024. https://www.youtube.com/watch?v=PaSA6uBmBLg