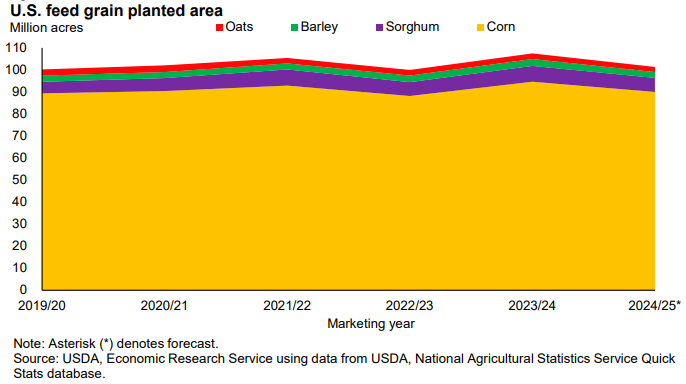

U.S. corn ending stocks are lower this month after upward adjustments for corn ethanol and feed and residual use. Based on second quarter indicated disappearance in 2023/24, feed and residual corn use is raised by 25 million bushels to 5.7 billion. Corn used for ethanol production is raised by the same volume and is expected to reach 5.4 billion bushels. The 2023/24 season-average farm corn price is lowered by $0.05 per bushel to $4.70 per bushel. Looking ahead, USDA, NASS’s Prospective Plantings report indicates total feed grain acres are expected to fall in tandem with principal crop acres for 2024/25.

Corn production is reduced in South Africa, Argentina, and Mexico. Mexico’s corn imports are raised, with the country being forecast to become the second-largest global corn importer, following China. Projections for barley imports by China continue to increase, sourced mainly from Australia, but also from Russia and Kazakhstan. Saudi Arabia’s lower demand for composite feed is expected to limit feed use and its imports of corn and barley.

Domestic Outlook: Prospective Corn Plantings Are Lower for 2024

The USDA, National Agricultural Statistics Service (NASS) Prospective Plantings report indicates corn acreage is expected to be down 4.61 million acres from last year at 90 million acres. Reductions in acreage are expected across 38 of the 48 estimating U.S. States. While not completely offsetting, many of these acres will likely be replaced with soybeans. Market conditions have incentivized plantings of other crops, or none at all, resulting in an overall decrease in principal crop acres.

While it is early in the planting season, conditions have spurred a slight uptick in planting pace. In fact, the Weekly Weather and Crop Bulletin published by USDA, NASS and the World Agricultural Outlook Board (WAOB) indicates soil temperatures in many States across the Corn Belt are near, or above, necessary levels for corn development (50 degrees Fahrenheit). In particular, this is the case for a seemingly larger portion of the Western Corn Belt, as of April 6, 2024, relative to the same time last year. Although soil temperatures in the Northern Plains (particularly in the Dakotas) are not quite warm enough to support corn plantings, they are much warmer than this time last year.

Moreover, USDA, WAOB’s U.S. Drought Monitor shows a smaller portion (5 percent) of the new corn crop is in drought relative to last year. These factors are relevant when thinking about preventative planting possibilities as the season progresses. Thus, despite the reduction in corn acreage, conditions for the 2024/25 corn crop are better than this time last year.