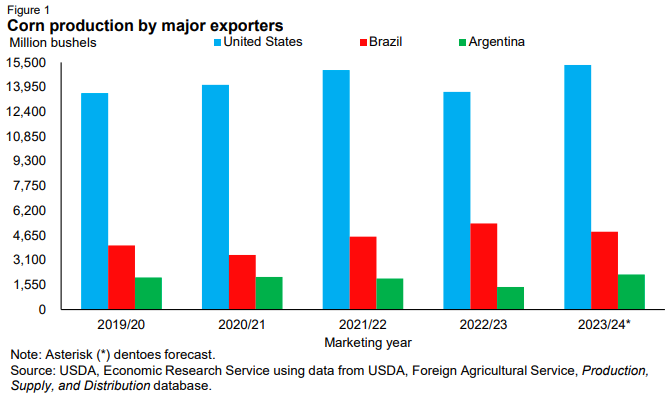

Expectations of a recovery in global corn production for 2023/24 have contributed to a reversion of U.S. corn market prices to lower levels. For context, a series of production setbacks in major corn producing—and exporting—countries over the past 5 years (see figure 2) resulted in price run-ups to levels not seen since the 2012 U.S. drought. For the 2023/24 marketing year, a record U.S. crop is complemented by healthy prospects for Argentina and Brazil—providing a year-over-year boost to the global corn supply—ultimately placing downward pressure on prices.

Over the past 5 years, U.S. corn prices peaked across principal cash markets, just shy of $9 per bushel. However, just over a year later, prices in these same markets were 40 percent lower (on average) to start the 2023/24 marketing year. Throughout the next 6 months, U.S. corn-cash prices fell $0.55 per bushel in Central Illinois, for example, and by $0.88 per bushel in the Louisiana Gulf.

The lower cash-market prices have been transmitted to average-farm prices. The average price U.S. corn farmers received in September 2023 was $5.21 per bushel, compared to $4.74 per bushel in January 2024—a nearly $0.50 per bushel reduction. These factors have contributed to a $0.05 per bushel reduction in the projected average corn price received by U.S. farmers in 2023/24, to $4.75 per bushel.

Source: USDA... View Complete Report