Cash receipts from the sale of agricultural commodities are forecast to decrease by 4.7 percent.

Source: USDA Economic Research Service

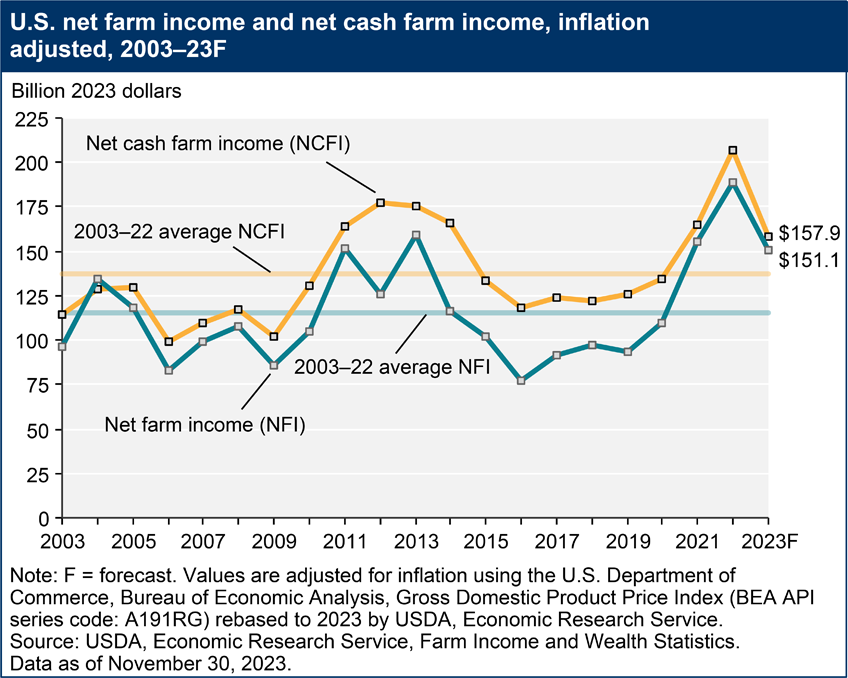

Net farm income, a broad measure of profits, is forecast at $151.1 billion in calendar year 2023, a decrease of $31.8 billion (17.4 percent) relative to 2022 in nominal (not adjusted for inflation) dollars. This follows an increase of $42.4 billion (30.2 percent) from 2021 to a record high of $182.8 billion in 2022. After adjusting for inflation, net farm income is forecast to decrease $37.9 billion (20.0 percent) in 2023 relative to 2022. Despite this expected decline, net farm income in 2023 would be 31.4 percent above its 20-year average (2003–22) of $115.0 billion in inflation-adjusted dollars.

Net cash farm income is forecast at $157.9 billion in 2023, a decrease of $42.5 billion (21.2 percent) relative to 2022 (not adjusted for inflation). This follows an increase of $51.1 billion (34.2 percent) from 2021 to 2022. When adjusted for inflation, 2023 net cash farm income is forecast to decrease by $49.2 billion (23.8 percent) from a record high of $207.1 billion in 2022. Despite the decrease, net cash farm income in 2023 would be 15.0 percent above its 2003–22 average of $137.3 billion. Net cash farm income encompasses cash receipts from farming as well as cash farm-related income (including Federal Government payments) minus cash expenses. It does not include noncash items (including changes in inventories, economic depreciation, and gross imputed rental income of operator dwellings) reflected in the net farm income measure.

Cash receipts from the sale of agricultural commodities are forecast to decrease by $25.2 billion (4.7 percent, in nominal terms) from a record high of $534.8 billion in 2022 to $509.6 billion in 2023. Total crop receipts are expected to decrease by $12.1 billion (4.4 percent) from 2022, led by lower receipts for corn and soybeans. Total animal/animal product receipts are expected to decrease by $13.0 billion (5.0 percent), following declines in receipts for milk, broilers, eggs, and hogs.

Also contributing to lower forecast net income in 2023 are lower direct Government payments and higher production expenses. Direct Government payments are forecast to fall by $3.5 billion (22.3 percent) from 2022 to $12.1 billion in 2023. This decrease is expected largely because of lower supplemental and ad hoc disaster assistance in 2023 relative to 2022. Meanwhile, total production expenses, including operator dwelling expenses, are forecast to increase by $14.9 billion (3.5 percent) to $443.4 billion in 2023. Interest expenses and livestock/poultry purchases are expected to see the largest increases in 2023 relative to 2022.

Average net cash farm income for farm businesses is forecast to decrease 8.6 percent from 2022 to $99,300 per farm in 2023 (in nominal terms). Six out of nine USDA, Economic Research Service (ERS) Farm Resource Regions are expected to see average net cash farm income fall in 2023 relative to 2022, with farm businesses located in the Northern Crescent region expected to see the largest decline. In contrast, the average net cash farm income for farm businesses in the Eastern Uplands region is forecast to increase from 2022 to 2023. When grouped by commodity specialization, all farm businesses specializations except cattle/calves, wheat, and specialty crops are forecast to see lower average net cash income in 2023. Farms specializing in dairy are expected to see the largest decline relative to 2022.

Farm sector equity is expected to increase by 6.9 percent ($229.4 billion) in 2023 to $3.57 trillion in nominal terms. Farm sector assets are forecast to increase 6.6 percent ($254.0 billion) in 2023 to $4.09 trillion following expected increases in the value of farm real estate assets. Farm sector debt is forecast to increase 5.0 percent ($24.6 billion) in 2023 to $520.7 billion. Debt-to-asset levels for the sector are forecast to improve from 12.93 percent in 2022 to 12.73 percent in 2023. Working capital is forecast to fall 5.0 percent in 2023 relative to 2022.