Scott Brown - Livestock economist with the University of Missouri

Beef Outlook: Lighter carcass weights do not produce enough premium beef cuts to meet demand.

The recent progression of the beef and cattle industry to a higher-quality product has been nothing short of phenomenal, but can that trend continue?

Although total U.S. beef production increased by a mere 2% between 2008 and 2020, the volume of fed steer and heifer beef grading Prime increased by an amazing 372% during that period. In addition, branded beef loads jumped 110%, while those loads grading Choice mirrored the total beef production increase of 2%.

But since 2020, these trends have all but disappeared.

It is often premature to declare the end of a longer-term trend based on just a few observations, particularly when those years include extreme shocks to both beef demand and supply fundamentals. However, it is worth considering whether changes to the quality beef supply and demand mix are at a point where continued transition will be more difficult to achieve.

Supply of beef on ‘lighter’ side

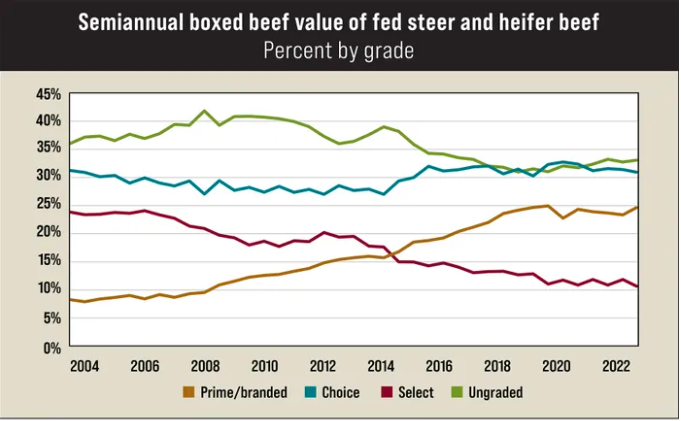

The graph for this article shows the composition of the total wholesale value of fed steer and heifer beef among four different quality tiers.

Looking at the total wholesale value allows some discussion of supply and demand, as the total value is determined by the quantity of beef receiving a particular grade and the per-unit price for that quality grade.

There are both supply and demand considerations that limit further growth in the share of Prime/branded beef value since 2020.

On the supply side, cattle dressed weights are set to decline for the third consecutive year in 2023, following a large increase in 2020. Two factors in this weight decline are sharply higher feed prices and the pulling forward of cattle through the supply chain as total cattle numbers decline.

Research shows a correlation between heavier carcass weights and higher levels of marbling, an important characteristic in achieving high-quality status. But the multiyear decline in carcass weights limits the availability of high-quality beef.

Economy threatens beef demand

Consumer willingness and ability to consistently pay for beef in the highest quality and price tiers will likely affect demand.

Demand-side factors limiting consumer confidence include:

- the pandemic and its aftermath

- the highest inflation in a generation

- the general economic uncertainty

Beef has fared better than other commodities in terms of demand strength over the past year. However, premiums for Prime and branded products have not moved high enough to make up for the reduction in quantity supplied. That does not allow for Prime/branded to continue to grow its percentage of total fed steer and heifer beef value.

It is important to understand that even if we have reached an end to (or at least a slowing of) the growth in Prime/branded value percentage, this in and of itself does not signify a loss for the beef industry.

For instance, comparing the first half of 2023 to last year indicates a 3.2% value increase for all fed steer and heifer beef production. Comparing it to the first half of 2021 shows this year at a 9.2% increase.

Analysts have pondered for years just how large the U.S. beef supply percentage ought to be at the highest-quality tiers to maximize consumer demand. It will take a few more years to fully determine whether the industry has now reached that threshold, or if short-term factors are preventing further increases.