Scott Brown - University of Missouri Livestock Economist

Market analysts expressed concern that lingering economic uncertainty and an increasing amount of time since stimulus payments bolstered household finances could lower consumer willingness and ability to buy meat.

Consumer meat demand strength is one of the most important factors in determining livestock prices. The beginning of the COVID-19 pandemic in 2020, and the market and government policy behavior that resulted during the return to relative normalcy, has made it difficult to gauge what has driven consumer meat purchasing behavior in recent years.

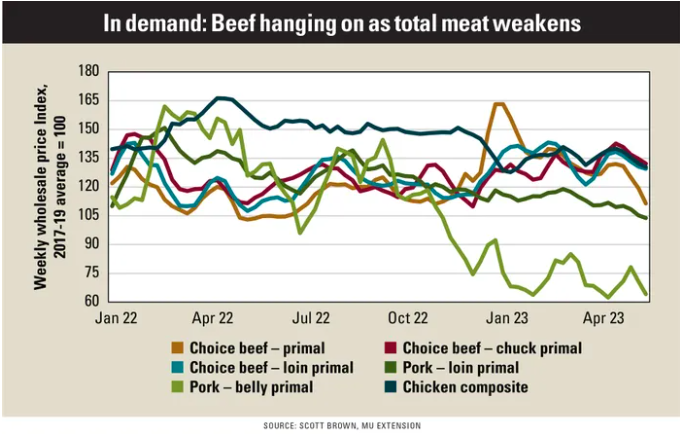

Examining weekly price behavior for six meat products at the wholesale level reveals that some of these concerns have come to fruition.

Meat production impact

Comparisons are made from the beginning of 2022 through mid-May 2023 against the average of 2017-19 for the same week of the year. (This eliminates the most dramatic short-term effects of the pandemic and provides a look at how demand for various meat products compares to its pre-pandemic level.)

While production levels are also key in determining market prices, there are not large deviations in beef, pork and chicken output for the period being considered.

U.S. beef production in 2022 was 5.8% larger than the 2017-19 average, compared to pork production that was 1.8% higher and chicken production that was up 8.2%. Beef production in the first quarter of 2023 was 6.7% above the first-quarter production average from 2017-19, similar to pork (+6.7%) and a little lower than chicken (+12.5%).

Although relative production levels do have a role to play in price determination, the supply differences observed between these species for the analysis period are not large enough to significantly affect price changes.

Problems for pork

Hog producers are currently struggling the most in terms of profitability, in some cases facing the worst bottom lines in the past 25 years.

Of the six products, we see that the pork belly primal experienced the largest price decline in recent weeks, with the pork loin also on a downward trend. It is interesting to note that with the exception of pork bellies, all other products maintained price levels above the 2017-19 average for every week since the beginning of 2022.

A little concerning for those in the cattle industry has been the steep decline in beef rib primal values thus far in 2023. The Choice beef chuck and loin primals remained relatively steady, along with the chicken composite wholesale value.

Short beef supply opportunity

With production growing as noted above, this has been one of the factors that helped most livestock producers weather the effects of much higher input costs.

The cattle industry is just entering a sustained period of reduced beef output. Recent USDA projections show a 5.4% decline in beef production for the second half of this year vs. 2022, and a further 8% output reduction in 2024.

These supply changes will place upward pressure on cattle prices, even if demand weakens a little more. What the industry needs to avoid is the sharp drop in demand that the pork industry is currently navigating.

Although consumers tend to cut back on higher-value products when finances get tight, beef demand thus far remains a bright spot.

Brown is a livestock economist with the University of Missouri. He grew up on a diversified farm in northwest Missouri.