Derrell S. Peel, Oklahoma State University

May is upon us with all the weather uncertainty that is typical of the month but also the assurance that summer is coming. The Memorial Day holiday at the end of the month will kick of the summer grilling season. Lots of attention is being focused on beef demand as the tightening of beef supplies will increase the pressure for higher wholesale and retail beef prices. How high can they go and how fast?

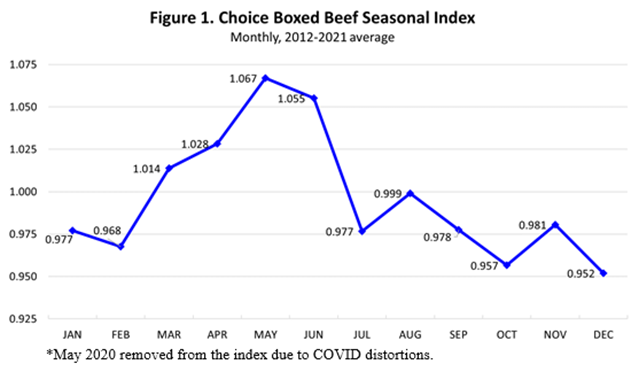

In the first full week of May, Choice boxed beef prices averaged $309.41/cwt., up over 9 percent from the beginning of the year and 20 percent higher year over year. The boxed beef price increase thus far in 2023 is following quite close to an average seasonal pattern as shown below.

Boxed beef prices typically peak in May with wholesale buying ahead of summer grilling season, before dropping lower in the second half of the year. The seasonal pattern of boxed beef prices reflects the net impact of seasonal demands for the various beef products that are included in the boxed beef price as reported by the Agricultural Marketing Service (USDA-AMS). Current daily boxed beef reports include prices for more than 40 different beef cuts and subprimals. The price seasonality of each of these products varies according to the different uses of the products and the alternative supply chains in which they are mostly marketed. Beef products may flow primarily through the supply chains of retail grocery, food service (including restaurants) or export markets. Nearly all of the reported wholesale beef prices are currently higher year over year.

The May peak in boxed beef price is largely driven by retail grocery demand for Strip Loins and Sirloin cuts that move primarily through retail grocery channels. Chuck Roll prices are also very strong currently, which may be driven by export demand and retail grocery demand, including ground beef. The most valuable cuts of Tenderloin and Ribeye are not typically seasonally strong this time of year, but both have been higher all year so far in 2023, reflecting continued strong restaurant demand.

Ground beef demand typically increases in the summer, not only because of grilling demand but also because more people are traveling and utilizing drive-throughs. Food service ground beef demand, especially the Quick Service Restaurants (QSRs), really heavily on beef trimmings as sources for ground beef production. The price of 90 percent lean trimmings (mostly cow beef), have beef rising all year and are currently moving higher than year ago levels. More dramatically, the price of 50 percent lean trimmings has moved sharply higher to a current level that is unprecedented except for a brief spike during the pandemic in 2020.

Tightening beef supplies, underlying general strength in beef demand and seasonal grilling demand are all pushing wholesale beef prices higher. Consumer beef demand has continued to be remarkably resilient and wholesale beef prices are likely to go higher yet as beef production continues to decrease going forward.