MarketWatch

The numbers: U.S. wholesale prices sank 0.5% in March to mark the biggest decline in almost three years, potentially a sign of further easing in inflation in the months ahead.

Economists polled by the Wall Street Journal had forecast no change in the producer price index. The drop last month was the biggest since the start of the pandemic in early 2020.

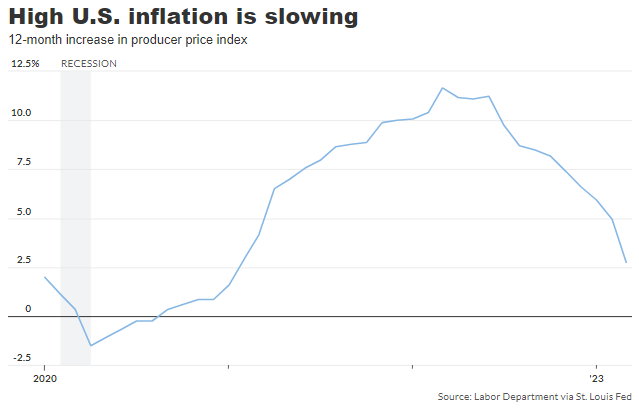

Wholesale costs often herald future inflation trends. The increase in wholesale prices over the past 12 months also slowed again to 2.7%, from 4.9% in the prior month. That’s the lowest reading since January 2021.

A separate measure of wholesale prices that strips out volatile food and energy costs as well as trade margins rose a scant 0.1% last month, the government said. That was also below Wall Street’s forecast.

The increase in these so-called core prices over the past year eased to 3.6% from 4.5%.

The PPI report captures what companies pay for supplies such as fuel, metals, packaging and so forth. These costs are often passed on to customers at the retail level and give an idea of whether inflation is rising or falling.

Key details: The decline in wholesale prices was partly exaggerated by a drop in energy prices and trade margins, two volatile categories prone to large swings.

The wholesale cost of goods dropped 1% last month and declined for the second month in a row, largely because of lower gas prices.

Prices could rise in the next few months, however, following OPEC’s cuts in production and a sharp rise in the cost of oil.

Wholesale food costs, on the other hand, rose 0.6% and broke a string of three straight declines. Food prices are still up 5.1% in the past year.

The cost of services slipped 0.3% and continued to soften. Service inflation had risen sharply in 2022 and is harder to reverse, making it a particularly big worry for the Federal Reserve.

Inflation further down the pipeline also signaled easing inflation.

The wholesale cost of partly finished goods fell for the eighth time in nine months. And the more volatile cost of raw materials declined for sixth time in the past seven months.

Both categories have turned negative in the past 12 months for the first time since the early stages of the pandemic in 2020.

Big picture: Inflation is slowing and is likely to continue to slow. Waning wholesale-price pressures point in that direction.

How quickly inflation slows will determine whether the Fed halts a series of interest-rate increases soon. The central bank has been increasing a key short-term rate since last year to slow the economy and temper inflation.

The higher rates go to tame inflation, the greater the odds of recession. Higher rates have already caused a slump in the housing market and turmoil in the U.S. banking system, as evidenced by the failure last month of Silicon Valley Bank.

Looking ahead: “Producer inflation is clearly in retreat,” said chief economist Chris Low of FHN Financial. “For a Fed already inclined to pause, this report tips the scale just a bit more in favor, especially after yesterday’s CPI failed to reveal any new inflationary problems.”