By Cassie Fish, http://cassandrafish.com

Last week was none short of a remarkable accomplishment for the cattle market. Negotiated cash fed cattle prices are $10/cwt higher in two weeks reaching an all-time historic high of $173.36 nationally last week. This price exceeded the prior all-time 2014 high of $171.38 with ease. Packers purchased 103k head, 85k in the 1-14 day window, trying to get a toehold of inventory. Packers can’t slow down, let alone stop the rally, if they don’t own enough inventory. Expectations for this week’s cash prices are generally higher.

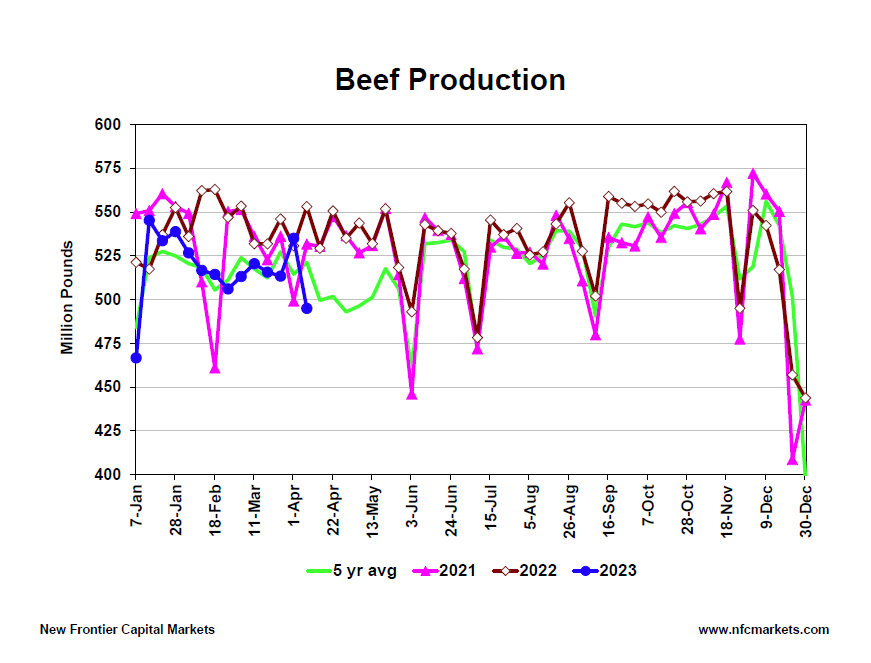

The other tool the packer has is slaughter levels. A dramatic drop in last week’s throughput, 603k head down 48k from the prior week, illustrated the packer pumping the brakes. Expectations are for packers to increase this week’s slaughter to 630k head, as boxed beef prices increase and post-Easter beef demand picks up. With carcass weights falling fast, last week’s light slaughter resulted in beef production plunging will below the 5-year average.

Choice boxed beef values advanced about $8/cwt with the chuck, round and loin all strong and continue to trade at record high prices for early April. The rib will likely kick into gear soon. Look for beef cutout values to advance seasonally 6 to 12 more weeks. The rally in the cutout will likely be enough to keep packer margins black, though this week’s margins will tighten most likely.

CME spot live cattle futures have come within 30 cents of the all-time high today. That all time high was $171.97 made October 2014, following a 15 month rally. Today’s high in April LC is marking the early stages of a long-term bull market, not the end. Today most active June LC is the strongest and only April and June have made contract highs today—as it should be given the strength in cash prices.

'The Beef' is published by Consolidated Beef Producers