Derrell S. Peel, Oklahoma State University

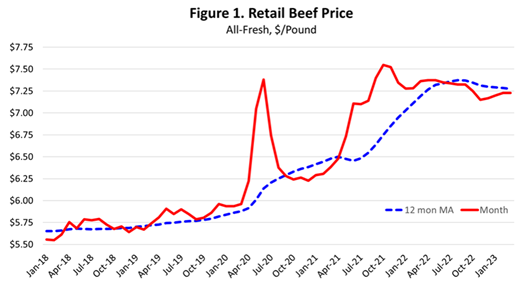

Retail all-fresh beef prices in March were $7.23/lb., unchanged from February and down 1.8 percent from one year ago. Retail beef prices have been mostly steady since late 2021 (Figure 1). The 12-month moving average of monthly retail beef prices has been above $7.25/lb. since April 2022 (blue line, Figure 1). This indicates strong beef demand given record beef production in 2022 and the highest beef consumption per capita at 58.9 pounds (unchanged from 2021) since 2010. Retail all-fresh beef prices averaged $7.30/lb. in 2022, the highest on record and up 5.1 percent over 2021 average retail prices. The highest monthly price ever was in October 2021 at $7.55/lb.

It does not appear that consumer beef buying behavior has changed significantly thus far with higher retail beef prices. There is little indication of consumers “trading down” i.e. switching to lower value products and away from more expensive beef cuts. Wholesale beef prices continue to be led by strong middle meat prices with tenderloins and ribeyes up 12-15 percent year over year. Chucks and round wholesale values are mixed across a range of products but chuck primals are up 10 percent year over year and rounds are unchanged. Briskets remain weak compared to last year. Both 90 and 50 percent lean beef trimmings have advanced significantly thus far in 2023, pushing ground beef prices higher. Higher ground beef prices are probably partly due to stronger demand but are mostly due to decreasing supplies of processing beef.

Choice boxed beef price averaged $297.91/cwt. last week, the highest weekly boxed beef price since late September 2021 and up 9.3 percent year over year. Boxed beef prices are pushing higher as a result of decreased beef production and supported by continued strong beef demand.

Beef production is down 4.6 percent for the year-to-date compared to last year. Decreased beef production is the result of declining cattle slaughter and lower carcass weights in 2023. Total cattle slaughter is down 2.9 percent thus far in 2023. Daily slaughter totals for the year-to-date show that steer slaughter is down 2.3 percent year over year, with heifer slaughter up 0.4 percent year over year leading to total fed slaughter down 1.2 percent for the year thus far. Total year-to-date cow slaughter is down 3.6 percent year over year with dairy cow slaughter up 4.6 percent year over year and beef cow slaughter down 10.3 percent year over year. Bull slaughter is down 9.6 percent thus far in 2023. Carcass weights for all classes of cattle are lower year over year with average cattle carcass weights down 15.2 pounds year over year. Steer carcass weights have averaged 14.7 pounds lighter this year with heifers averaging 19.2 pounds lighter and cow carcass weights smaller by 11.6 pounds compared to one year ago.