Derrell S. Peel, Oklahoma State University

The latest USDA Cattle on Feed report showed March 1 feedlot inventories at 11.645 million head, down 4.5 percent year over year and the lowest March inventory since 2017. Placements in February were down 7.2 percent year over year and the sixth consecutive monthly decrease in placements. In fact, placements were down 10 of the past 12 months. February marketings were down 4.9 percent from one year earlier.

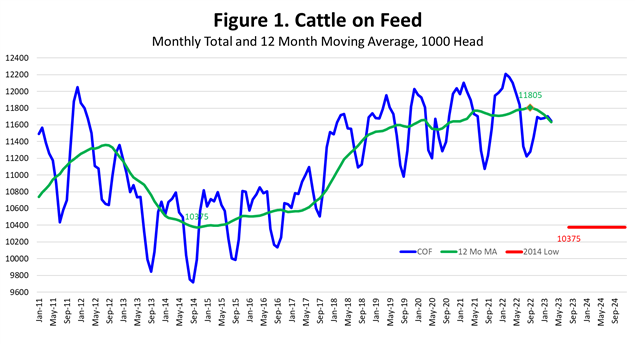

Figure 1 shows monthly inventory totals (blue line) and a 12-month moving average (MA) of monthly feedlot inventories (green line) since 2011. While monthly feedlot totals vary seasonally, the moving average removes the normal seasonality so that changes month to month indicate the underlying trend in feedlot production. March 2023 was the sixth consecutive month of declining feedlot inventories year over year. With feedlot totals decreasing since October, the MA peaked in September 2022 at 11.8 million head, dropping to 11.63 million head as of this latest report, the lowest level since October 2020.

Declining feedlot production leads immediately to two questions. How low will feedlot inventories go in the coming months? And when will the low happen? Figure 1 may provide some indications of what to expect. The previous multi-year low in the feedlot inventory MA was in October 2014, after drought-forced herd liquidation in 2011-2013. The current beef cow herd is slightly smaller that the 2014 herd level. The beef cow herd is likely to drop a bit more in 2023. It is reasonable to expect that average feedlot inventories will drop close to the 2014 low of 10.375 million head or possibly even lower at some point in the coming months.

The question of when that low will happen is trickier. Although there are expectations for diminishing drought conditions in 2023, the drought continues for now and it’s not clear whether liquidation will be pushed even further this year. The smallest calf crop of the next few years will be in 2024 at the earliest. Feedlot inventories will decline through 2023 with the low in 2024 or beyond. Figure 1 shows that the feedlot inventory MA decreased from August 2012 until October 2014 following the previous drought episode. This suggests that the coming feedlot low might not happen until late 2024 or later.

This leads to a third question of how long low feedlot inventories will persist. Figure 1 shows that, from the MA low in October 2014, average feedlot inventories increased very slowly until the fall of 2017 before increasing more rapidly through 2018 and 2019. Feedlot inventories remained relatively low for about three years. This was the period of herd rebuilding when heifer retention was at the highest levels, with replacement heifer inventories peaking in 2016 and 2017. Not until heifer retention slowed after 2017, were additional heifers available for feedlot placement. The number of heifers in feedlots on January 1 increased by 23 percent from 2017 to 2019.

It appears that the 2012-2017 period is a useful analog for the next few years regarding feedlot inventories. The current state of cattle inventories, especially the cow herd size, replacement heifer inventories and expected calf crops are generally analogous to the previous period beginning in late 2012. In fact, the current situation reflects a more severe depletion of female inventories compared to the 2012-2017 period. Based on the analog period, feedlot inventories will likely decline from the feedlot inventory MA peak in September 2022 to a level similar to the 2014 low in the coming months and remain relatively low for the next four years or longer.