According to a new report from Rabobank, 2022 was a year to remember for the global beef industry, with record retail and farmgate prices in many regions due to strong consumer demand and limited supplies. Brazil also achieved record export volumes and returns thanks to growing Chinese demand. However, consumer sentiment softened in late 2022, leading to weaker beef prices in early 2023.

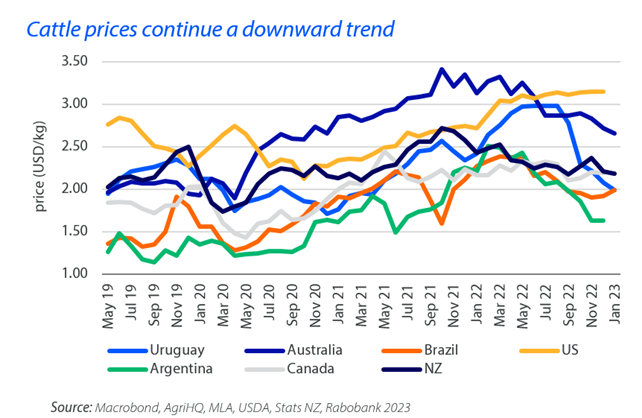

Total beef production is forecast to be steady in the first quarter of 2023, with a 5% lift in Australian and 2% increase in Brazilian production, almost enough to offset declines in the U.S., EU, and New Zealand. The global supply through 2023 is expected to become more limited as U.S. production dips. Cattle prices across most regions have continued their downward trend, with the notable exception being the U.S., where more limited supplies are providing price support.

“Consumer sentiment weakened in late 2022, leading to a softening in beef pricing that has flowed through into early 2023,” said Angus Gidley-Baird, senior analyst of animal protein at Rabobank. “While the supply of beef should remain favorable for prices, consumer confidence will continue to be a key factor in determining beef returns.”

China’s reopening and U.S. supply contraction bring opportunities

According to Rabobank, China will be a key focal point in 2023, as the country emerges from COVID lockdowns amid a slowing economic environment. The lifting of COVID restrictions is expected to lead to a rebound in household consumption, including a potential increase in beef consumption. Chinese demand for beef will pick up in the second half of the year, boosting global beef prices.

The report specifically noted that evolving market channels and consumer behavior are also influencing beef market development in China.

“While foodservice has previously been the main channel for beef consumption, we now see rising beef sales in retail channels. This trend is supported by the robust growth of new tech cookers and portable ovens,” the report noted.

Another rapidly growing trend is the pre-prepared dish market, with double-digit growth seen in the past two years.

Meanwhile, the contraction of U.S. production remains a focal point.

“The beef cow inventory has dropped to the lowest point since 1962, and feedyard inventories are showing a decline,” said Gidley-Baird. “This is expected to cause a redistribution of global beef supplies and an overall tightening of the market.”

The Brazilian beef supply is expected to be even higher this year, with China remaining Brazil’s the main export destination, though average import prices in 2023 will likely drop due to the increase in volumes. China was a top-three U.S. beef export destination in 2022, but growth in export volumes slowed throughout the year. Notwithstanding the recent ban of Brazilian beef export to China due to a case of atypical bovine spongiform encephalopathy, the decline in U.S. supplies and subsequent price increases will mean continued headwinds into China over the medium-term.

“The decline in U.S. volumes should support increased trade from Australia,” explained Gidley-Baird. “Australia’s volumes will likely lift as prices ease, further supported by the potential increase in demand for chilled products with the growth in China’s retail beef sales. Meanwhile, an increase in retail sales via e-commerce and growth in the prepared dish market will provide opportunities for New Zealand exporters to capture more value.”