MarketWatch

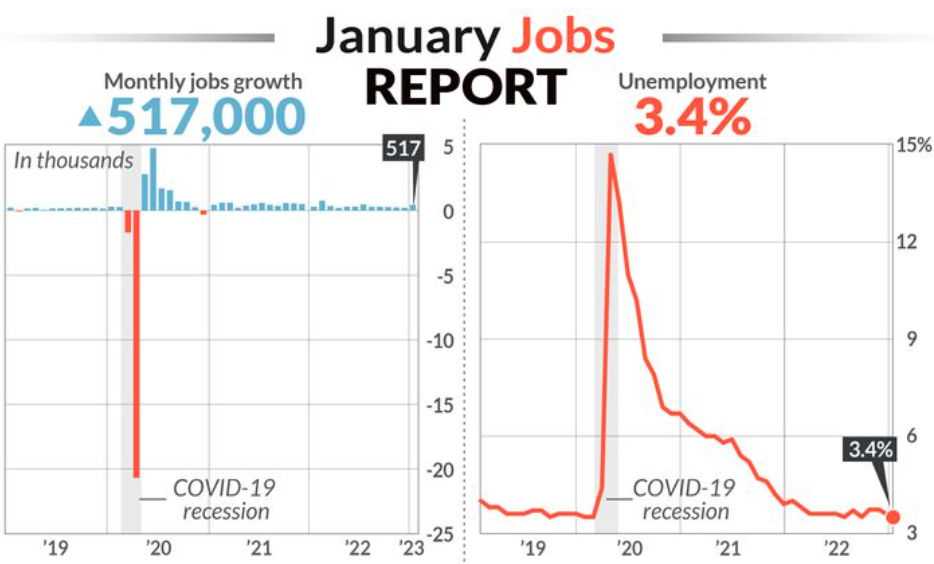

The numbers: The number of new jobs created in January rose by 517,000 to mark the biggest gain in six months, suggesting persistent strength in a muscular U.S. labor market even though the economy has shown signs of fraying.

The increase in new jobs was much stronger than the 187,000 forecast of economists polled by The Wall Street Journal. It could also put more pressure on the Federal Reserve to take take sterner measures to combat inflation.

One caveat: The government’s formula to adjust for seasonal swings in hiring sometimes exaggerates employment levels in January. It’s unclear whether that was the case last month.

Yet employment grew even faster in the waning months of 2022 than previously reported, indicating the labor market is still quite robust.

What’s more, the unemployment rate slid to a 54-year low of 3.4% from 3.5%, the government said Friday. That’s the lowest level since 1969.

In another sign of the strong demand for labor, the number of hours people work jumped 0.3 hours to 34.7 hours, matching the highest level in a year.

The only seeming sign of moderation in the report was a 0.3% increase in hourly pay.

As a result, the increase in hourly pay over the past year slowed again to 4.4% from 4.8%, indicating some relaxation in wage pressures.

Still, the broad strength of the report is likely to worry the Federal Reserve and keep the heat on the central bank to raise interest rates.

The Fed has been worried about the tight labor market driving up wages and making it harder to bring down high inflation.

U.S. stocks DJIA, 0.09% SPX, -0.35% fell in premarket trades and bond yields rose after the report.

Key details: Most major industries added workers last month.

Hotels and restaurants (128,000) led the way, but hiring was also strong among health care providers and white-collar professional businesses.

The only parts of the economy to shed jobs was information services, a category that includes the media and some high-tech businesses. Many companies in those fields have announced layoffs in recent months.

The share of working-age people in the labor force — known as the participation rate — moved up a tick to 62.4% from 62.3%.

It’s still well below pre-pandemic levels, however, and reflects the yawning gap between the demand for labor and supply of willing workers.

Hiring was also stronger in the second half of 2022 than previously reported after government revisions. The economy created an additional 304,000 jobs from July through December compared to earlier estimates.

Big picture: The economy is slowing and the threat of recession is rising as higher interest rates depress growth. Many large companies such as Amazon AMZN, -4.74%, IBM IBM, -0.33% and Fedex FDX, -0.19% have announced layoffs and more job cuts are expected.

Yet the labor market has also proven quite resilient and lots of businesses are reluctant to fire workers given how hard it was to hire them in the first place. The U.S. might even be able to avoid a recession if job losses remain on the low side.

The path of the economy will depend on how much higher the Fed raises interest rates in its battle to quell inflation. Price pressures are receding, but inflation is still way too high for the Fed to stomach.

Looking ahead: “Businesses continue to try and retain as many workers as they can, despite a slowdown in economic activity and an increasingly uncertain outlook,” said money market economist Thomas Simons at Jefferies LLC.

“A stunningly strong jobs report raises serious doubts about the economy slipping into recession and the Fed ending its tightening cycle this spring,” said Sal Guatieri, senior economist at BMO Capital Markets.