Brazil, the world’s biggest beef exporter, is halting exports of the red meat to China starting Thursday after confirming a case of the animal illness known as mad cow disease.

The case of bovine spongiform encephalopathy was confirmed by Brazil’s Agriculture Ministry on Wednesday, and shipments to China were halted as part of a trade protocol between the two nations. Brazilian authorities will be holding conversations with Chinese counterparts in a bid for a “prompt re-establishment” of trade flows, the ministry said in a statement.

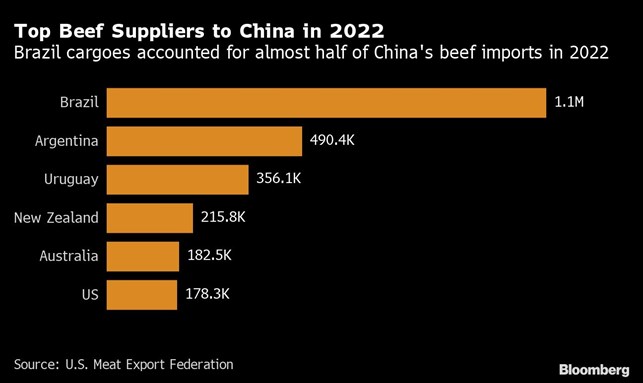

The export suspension is a blow to some of the world’s major meatpackers, including JBS SA, Marfrig Global Foods and Minerva SA. China, the main destination for Brazilian beef, accounted for almost 60% of the nation’s exports last month. Brazil was also the top beef supplier to China last year, ahead of Argentina and Uruguay. Meat company shares plunged in Brazil on Wednesday.

Samples of the infected animal were sent to a lab in Alberta, Canada, to determine if the case is “atypical.” The atypical variety differs from “classical” BSE linked to Creutzfeldt-Jakob disease in people. An atypical case also generally means the animal contracted the disease spontaneously, not through contaminated meat-and-bone meal.

The ban on shipments to China is only expected to last a short time if the case is atypical, said Pan Chenjun, a senior analyst at Rabobank. Still, there’ll be a significant impact in the meantime because Brazil is such a large supplier. Other South American exporters may benefit as they have similar products.

China Customs, the Ministry of Commerce and the Ministry of Agriculture and Rural Affairs didn’t immediately respond to faxes seeking comment.

The mad cow case was detected in a nine-year old cow in Maraba, Para state. The animal, which was fed on grass only, was culled and its carcass incinerated on the farm. The last atypical mad cow case in Brazil happened in 2021, when China took three months to lift an export ban.

Based on the outlook for tight global beef supplies and the Chinese economy growing more than in 2022, it is possible that the ban will be shorter compared with 2021, according to Hyberville Neto, director at HN Agro consultancy.