Cutter cow beef cuts (negotiated) have seen values rise in the last two years. Tenderloins have seen some of the highest average values and in 2022 will average an annual price very similar to 2015. Flank steaks and Ribeye Rolls over 8 pounds will surpass those levels while other cuts dipped from 2021’s higher prices.

The lean product on the national weekly cutter cow cutout report is for the 90% lean, 100% lean inside round, 100% lean flats and eyes, and the 100% lean S.P.B. The very lean cuts (100% lean) outpriced 2014 and 2015 last year and took a dip in 2022. Prices of 90% lean and the cutout value for cutter cows have not outpaced that time period yet.

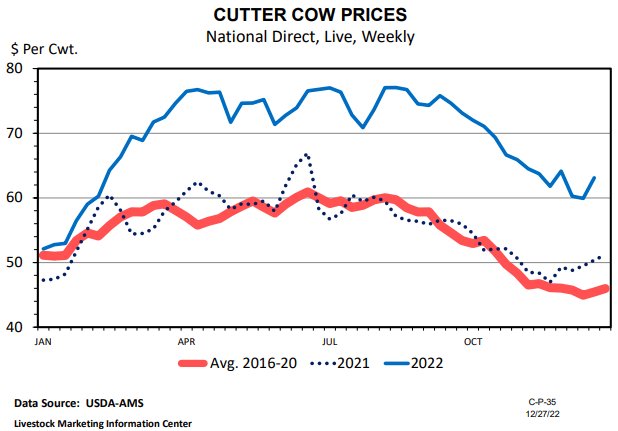

It’s worth nothing that all these products saw extraordinary prices considering the shear volume of cow slaughter that moved through the system in the last two years. Cull cow values also experienced strong prices in 2022 further emphasized that the demand pull for these products was far reaching. The next two years’ product availability is expected to be substantially smaller than in 2021 and 2022 as cow slaughter pulls back. LMIC has cow slaughter forecasted to drop 6% in 2023 from 2022 volumes and another 14% in 2024 from 2023 volumes.

This may create price volatility and may contribute to even higher prices for some of these cow products in the next couple of years. The supply situation will likely be able to mask some demand weakness in the U.S. and keep prices elevated even if there is a pull back in demand. Annual cutter cow cutout as well as cutter cow values could very likely see a new historical record high in the next 2-3 years.

The economy and relative price changes compared to other animal proteins and products may influence how consumers view beef, but it is hard to imagine the U.S. operating in a world where a burger was not a favored entrée away from home.

Daily Livestock Report - Steiner Consulting Group