Scott Brown - Livestock Economist with the University of Missouri

With beef availability projected to decline sharply in 2023, and beef demand remaining on solid footing, cattle prices are almost certain to rise.

The most recent USDA monthly estimates peg the domestic per-person beef supply to decline by 5.6% next year. If this occurs, it will be the largest annual decline in U.S. consumer beef availability since 1987.

There have been four instances since 2000 when per-capita domestic beef availability fell by 3.8% or more, and all four translated to increases in fed-cattle prices.

When the supply dropped 4% in 2003, fed-steer prices advanced nearly 25%, similar to the situations in 2011 (a 3.9% decline in supplies led to a 20% price increase) and 2014 (a 3.8% decline contributed to a 23% price jump). However, in 2008, the fed-steer price only advanced 0.2% on a 4.3% drop in supply.

Circumstances around cattle prices

The financial situation for consumers is likely the biggest factor determining how cattle prices may respond to a tighter beef environment in 2023. With many analysts becoming more pessimistic about GDP growth in the year to come, it is becoming increasingly likely that 2008 may be the most analogous in terms of consumer finances of the four years noted above.

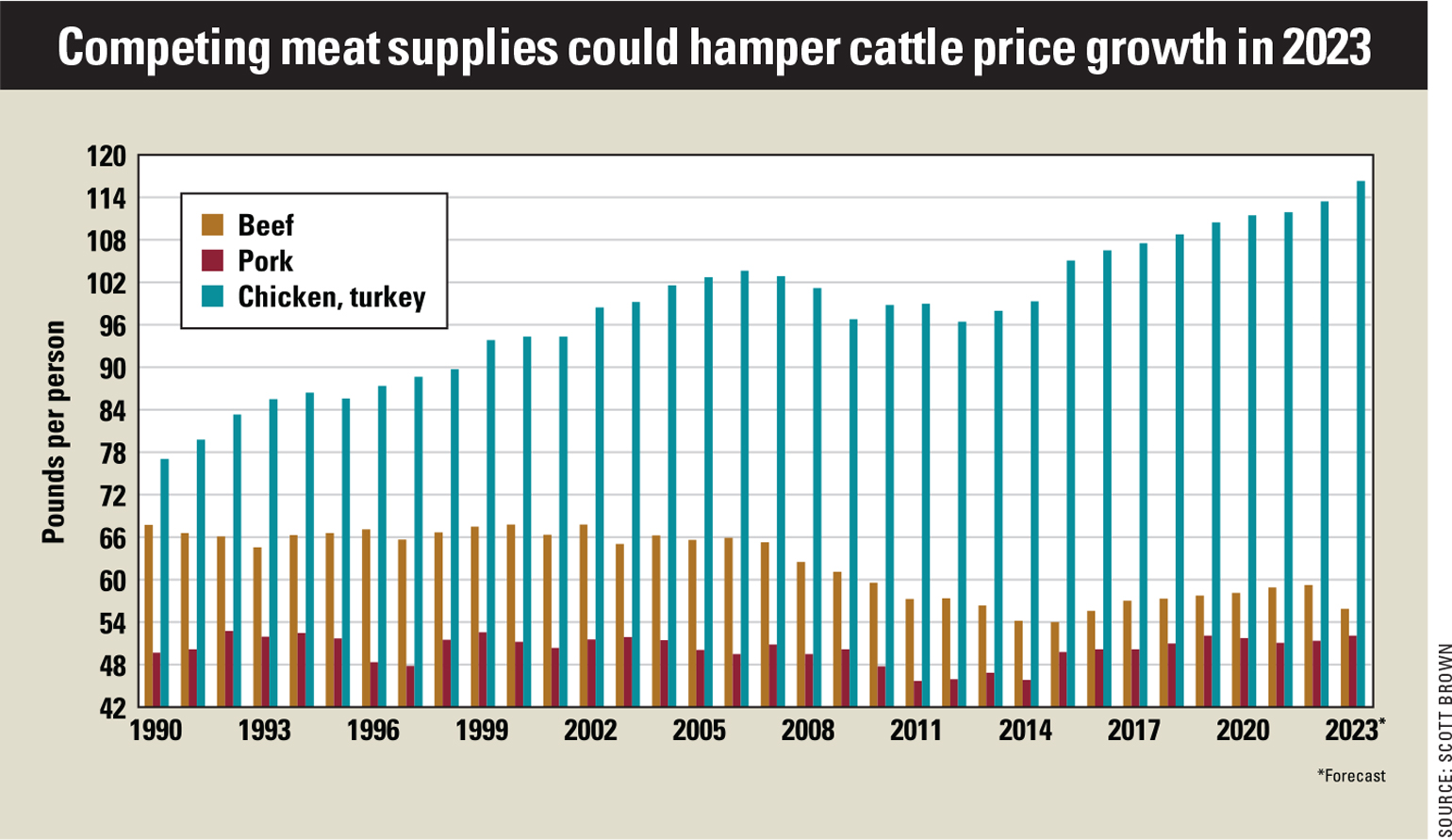

Another important factor to consider is the availability and affordability of competing meat products. While research has indicated that consumers are less likely to substitute away from beef based on competing meat prices than in the past, this is still an effect to consider, especially if difficult economic conditions cause many consumers to closely monitor their food expenditures.

Other meat supplies

The same recent USDA projections report that more pork, chicken and turkey will all be available next year than in 2022, with the domestic supply of the sum of the three 2.2% higher per person.

This points to more competition for beef in the retail meat case next year, as combined pork and poultry availability increases by the second-largest annual amount since 2002 (the pork industry’s recovery from the severe impacts of the porcine epidemic diarrhea virus in 2014 caused pork supplies in 2015 to increase substantially).

USDA projects hog prices to fall by 6% next year, with wholesale chicken prices retreating 7%, and turkey prices at the wholesale level down almost 2%.

The other years of sharp beef availability declines noted above included declines in competing meat supplies in 2008 (-2.0%) and 2011 (-1.3%), with only marginal increases in 2003 (0.7%) and 2014 (0.3%). Hog and pork prices increased in all those years, while chicken and turkey prices increased in three of the four.

While tighter beef supplies lend much optimism to the cattle price outlook, other factors might chip away at the price outlook for 2023. USDA’s recent projection of 8% growth in fed-steer prices seems to be a reasonable estimate, given all of the competing factors at play.