October ‘World Agricultural Supply and Demand Estimates’

LIVESTOCK & POULTRY: The forecast for 2022 red meat and poultry production is raised from last month, as higher beef, pork, and broiler forecasts are partly offset by lower turkey. Beef production is raised for the second half with higher expected slaughter as well as higher carcass weights for the period. Pork for the third quarter is raised on a higher than-expected slaughter; no change is made to the fourth-quarter forecast. Broiler production is raised on current slaughter data and higher eggs set and chicks placed. Turkey is lowered, with an increase in the third quarter more than offset by a reduction in the fourth quarter due in part to recent Highly Pathogenic Avian Influenza (HPAI) discoveries.

For 2023, the red meat and poultry production forecast is raised on higher beef and broiler production. Beef is raised on higher expected placements in late 2022 which will be marketed in the first half of 2023. Broiler production is raised on expected growth in eggs set and chicks placed during the year. Pork is lowered on expected farrowings and modest growth in pigs per litter. Turkey is lowered slightly for the first two quarters.

Beef imports for 2022 are lowered on slower third quarter exports. Exports are raised on the current pace of trade in the third quarter but the forecast for the fourth quarter is unchanged. Beef imports for 2023 are raised. 2023 exports are forecast higher on expectations of firm demand in a number of Asian markets. Pork imports and exports are lowered for 2022 on recent data. For 2023, pork exports are lowered on tighter domestic supplies and weaker demand in several markets. Broiler export forecasts for 2022 and 2023 are unchanged. Turkey exports are lowered for 2022 but raised for 2023.

Cattle price forecasts for 2022 are raised on current strength in packer demand, but forecasts for 2023 are unchanged. The 2022 hog price forecast is lowered on recent prices, and 2023 prices are also lowered on weaker expected demand and competition from increased broiler supplies. Broiler price forecasts for 2022 and 2023 are lowered on higher forecast production. Turkey price forecasts for both 2022 and 2023 are raised with lowered production forecasts.

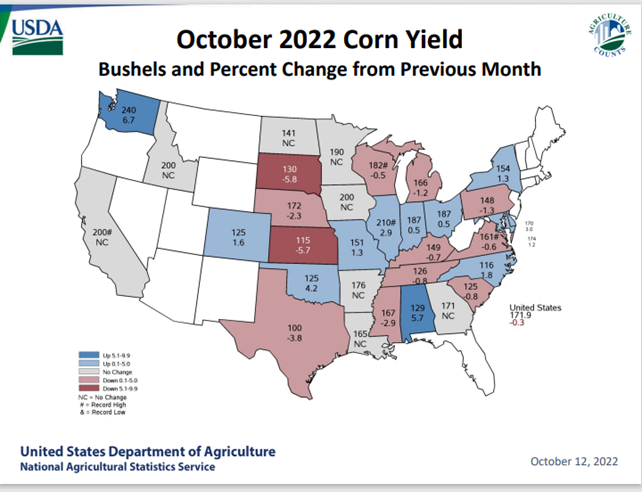

COARSE GRAINS: This month’s 2022/23 U.S. corn outlook is for reduced supplies, greater feed and residual use, lower exports and corn used for ethanol, and smaller ending stocks. Corn production is forecast at 13.895 billion bushels, down 49 million on a reduction in yield to 171.9 bushels per acre. Corn supplies are forecast at 15.322 billion bushels, a decline of 172 million bushels from last month, as lower production and beginning stocks are partially offset by higher imports. Exports are lowered 125 million bushels reflecting smaller supplies and slow early-season demand. Projected feed and residual use is raised 50 million bushels based on indicated disappearance during 2021/22. Corn used for ethanol is lowered 50 million bushels. With supply falling more than use, corn ending stocks for 2022/23 are cut 47 million bushels. The season-average corn price received by producers is raised 5 cents to $6.80 per bushel.

Global coarse grain production for 2022/23 is forecast down 3.8 million tons to 1,459.8 million. The 2022/23 foreign coarse grain outlook is for lower production, greater trade, and smaller stocks relative to last month. Foreign corn production is reduced as declines for the EU and Serbia are partly offset by an increase for India. EU corn production is lowered reflecting reductions for Romania, Bulgaria, Hungary, and France. India corn production is raised based on the latest government statistics.

WHEAT: The outlook for 2022/23 U.S. wheat this month is for lower supplies, domestic use, exports, and stocks. Supplies are reduced on lower 2022/23 production based on the NASS Small Grains Summary that indicated reductions in both harvested area and yield. This lowered production by 133 million bushels to 1,650 million, leaving production only minimally higher than last year. Partially offsetting the production decline are higher projected imports, raised 10 million bushels to 120 million, all for Hard Red Spring. Annual feed and residual use is lowered 30 million bushels to 50 million, based on first quarter disappearance, as indicated in the NASS Grain Stocks report. This is the lowest first quarter total disappearance since 1983/84. Wheat exports are lowered 50 million bushels to 775 million on reduced supplies, slow pace of export sales, and continued uncompetitive U.S. export prices. This would be the lowest U.S. wheat exports since 1971/72. Projected ending stocks are lowered 34 million bushels to 576 million, which would be the lowest since 2007/08. The season-average farm price is raised $0.20 per bushel to $9.20 on reported NASS prices to date and expectations for futures and cash prices for the remainder of 2022/23.

The global wheat outlook for 2022/23 wheat is for reduced supplies, consumption, trade, and stocks. Supplies are lowered 1.9 million tons to 1,057.7 million on reduced production for the United States and Argentina more than offsetting higher EU production although world production remains at a record. Argentina is lowered 1.5 million tons to 17.5 million with reductions in both area harvested and yield on continued widespread dry conditions. EU production is raised 2.7 million tons to 134.8 million, mainly on higher government estimates from Poland and Germany.