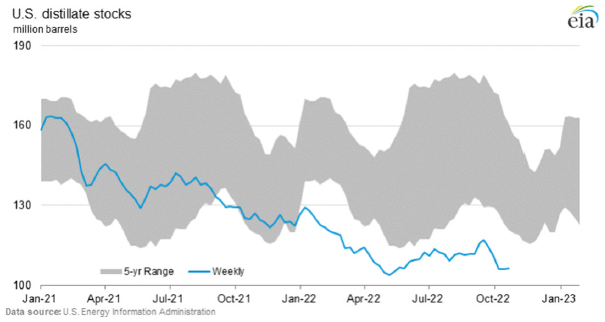

Freight costs remain a major challenge for the industry at large and unfortunately despite the recent pullback in crude oil prices, it appears freight costs are likely to remain elevated ‐ at least through the winter. A recent update from the US Energy Administration put distillate inventories (diesel, heating oil) at just 106 million barrels, well below the five year range and also at the low end of the range for the last forty years. Tight inventories continue to underpin diesel and heating oil prices.

The average heating oil price for the week was pegged at $5.704/gallon, up 68% compared to a year ago. The trajectory of fuel oil prices will depend in part on the severity of winter weather this year. Diesel prices seemed to ease a bit towards the end of the summer but they have started to climb higher again. For the most current week the average price of diesel fuel in the US was $5.341 per gallon, up 9.2% in the last four weeks and 44% higher than last year. There is a wide range of diesel prices around the country, reflecting regional supply availability and tax structure. For the most current week the lowest price of diesel was in the Gulf Coast at $4.987/gallon and the highest price was in California at $6.331/gallon.

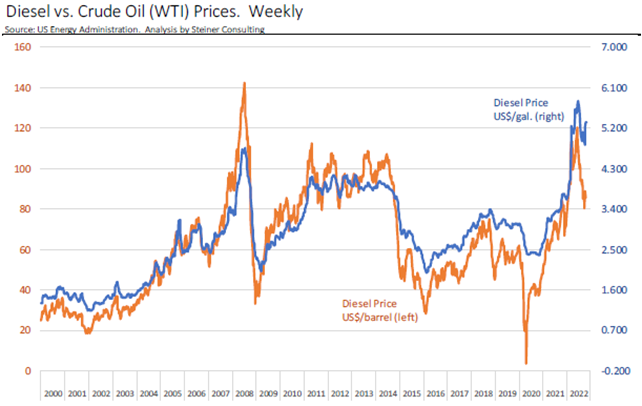

Normally the price of diesel will track with crude oil prices since it is the biggest contributor to its production cost. Last year crude oil accounted for about 49% of the overall cost of diesel fuel. Distribution and marketing was 20.2%, federal and state taxes made up 17.4% and refining costs accounted for 13.5%. But as the chart to the right shows, the spread of diesel vs. crude has widened significantly this year as market has been unable to bolster supply quickly enough to match up with demand. Inventory depletion means that higher prices are needed in order to limit the quantity demand even though crude prices may be down. In its October outlook EIA noted that diesel prices for 2022 will be up about $1.7/gallon vs. the previous year and only $0.7 of the increase is due to higher crude oil prices. The rest has gone to a larger wholesale and retail margin. Diesel fuel affects the entire food supply chain, from the tractors and pick up trucks on the farm to the trucks that deliver grains and livestock to plants and the vehicles that move meat products and finished goods to processing plants and retail stores.

Diesel fuel is a key component for freight costs but it is not the only one. Labor, equipment and overhead are an important consideration as well. According to an index of freight trucking from the US Bureau of Labor Statistics, freight costs have been rising at a slower rate. But keep in mind that they are still rising. In September the freight PPI was up 20% compared to the previous year. Earlier in the year costs were up as much as 37.5% y/y. But cost is still up and it is now 49% compared to January 1, 2020 before the start of the pandemic. Higher labor and other costs are already baked in, and those costs will continue to flow through into the various products traded and ultimately paid for by the US consumer.

Daily Livestock Report - Steiner Consulting Group