Source: Stephen R. Koontz - Colorado State University

I have had a number of inquires regarding the strength in beef prices: what is the source? My response has been that if beef prices are strong and supplies are reasonably abundant then the only thing that it can be is the strength in demand. It’s the consumer – both domestic and international – and the downstream market. This strong consumer demand in being revealed in retail prices and strengthening the wholesale and farm level prices.

From a market fundamentals perspective, monthly beef production is strong running better than 1% above the year prior. The total volume for 2022 will be slightly smaller than 2021 and comparable to 2019. These are large volumes of beef. Forecasts for the third and fourth quarter reveal drops in production but current weekly slaughter remains strong. Those declines have not yet materialized.

Domestic consumption is likely flat in the second quarter but was large in the first. Again, the third and fourth quarters are forecast to be lower especially if strong beef exports persist. (Consumption is production less net exports.) Current monthly beef net exports for 2022 are on path to be record large.

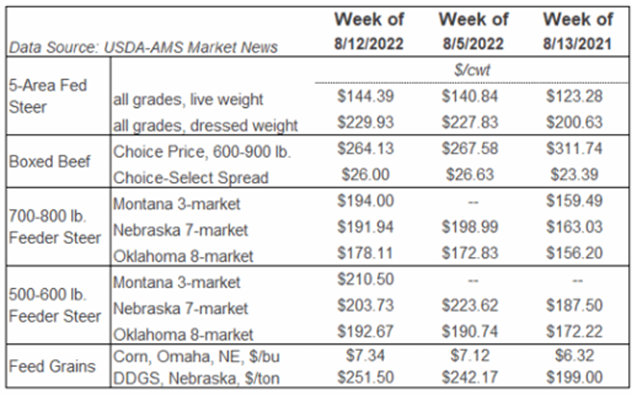

Retail beef prices spiked following the COVID shutdown to levels I anticipated not seeing again for the foreseeable future. But those price levels were seen across much of 2019 and we are close to those levels now. Retail beef margins are very strong. The Daily Livestock Bulletin has done a story about forward beef sales and the strength of those prices and possible featuring that is worth a read. Forward or not packer margins are solid and fed cattle prices are benefiting. But the number of long-fed cattle remain persistent. Fed cattle are trading in the high $144-$148 with some trades reported at $150. These are levels not seen since 2015.

And cash prices for feeder animals in the week of August 12 across a number of regional markets – Oklahoma City, Montana, and Colorado – were also at levels not seen since 2015. 700-750 Medium & Large Number 1 Feeder Steers in OKC at $180.60/cwt.

The Markets

What does the technical picture say? The entire cattle complex is in largely the same technical pattern. Since late May, all contracts are in an uptrend. The downtrend from February through May was broken in June and confirmed in July. The breaking of downtrends and establishing of uptrends are as clear buy signals as can be seen in cattle markets. All contracts are currently sitting at or close to the contract highs established back in February. This would normally be a sell signal by itself, but the trends are important. So, the question becomes what technical pattern gives up? Does the trend hold and resistance break – maintaining the buy signal. Or does the trend break and resistance hold – creating a sell signal.

With demand we are seeing my money would be on the trend lines. But I also have no doubt the market will have to work for it. We need to wait for the technicals to generate the signal.