Steiner Consulting Group

Cash cattle prices have continued to remain strong and found a new top last week. However, this week is normally a critical window to see price break just ahead of the 4th of July holiday. The addition of a new (last year) federal holiday ifor of Juneteenth may also differ historical patterns. No trade was reported yesterday in the 5-area live steer trade. Boxed beef cutout values have not rallied seasonally either but have maintained a historically strong value. It’s a couple of weeks later than the 5-year average shows as a normal seasonal decline. Continued large numbers of animals on feed would not put it out of the question to see cutout slip heading into July.

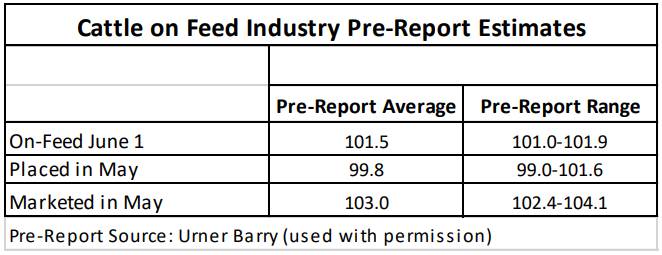

Cattle on Feed report is due out this Friday and the pre-report analysis has many considering the June 1 figure to be very close to a record high for the month. Marketings are expected to rise 3% on one extra slaughter day. The slaughter day count does not exclude Juneteenth from slaughter days. Daily estimated slaughter implies most packers opted out of the new federal holiday and cattle harvest was expected at 124,000 head.

Placements in May were estimated on both sides of even with a year ago, without clear direction. Anecdotally the last two weeks of May/first half of June showed considerable improvement in forage outlook in the Southern Plains and Kansas. Weight groupings of placements should offer some insights to how much of these cattle are drought placements.

Large placements earlier in the year were associated with cattle moving off of wheat pasture earlier than normal. The seasonal index for Texas placements over the last 20 years shows May is typically a large placement month for Texas cattle regardless of feeder size. However, larger deviations exist in weight categories over 700 pounds. January and February have been the only two months Texas placements have been over the five year average in 2022. Kansas placements have been larger than the 5 year average in each month of 2022. The five year average for Kansas in May is 457 thousand head compared to Texas’s 582 thousand head.

Texas placements have been down below 2021’s figures in every month this year with the exception of March. Kansas placements have mostly been larger to even with 2021 for most of 2022. It remains to be seen if rain in these areas came in time to change the trajectory for the month of May.