American Farm Bureau Federation

Introduction

At first glance, 2022 cattle prices are higher than 2021. At $140, slaughter steer prices are 17.5% above 2021 prices, but even with higher prices, farmers and ranchers will travel a rocky road to profitability, paved with inflation and higher input costs in 2022. This Market Intel addresses the USDA’s Cattle on Feed report released on Friday, May 20, 2022, the forces driving cattle prices higher and how inflation and input costs will affect the bottom line for cattle farmers and ranchers. It will further walk through the combination of supply and demand factors that will affect the 2022 market outlook for livestock producers.

Supply - Inventory

The Annual Cattle Inventory Report published by USDA estimated overall inventory on January 1, 2022, is down 2% or 1,887,700 head from 2021. Cattle inventory is important with respect to the market outlook because it quantifies supply and where the industry lies in what is known as the cattle cycle. The cattle cycle is the waves of expansion and contraction of the total number of U.S. beef cattle in consecutive years. The cattle cycle is a response to farmers’ and ranchers’ perceived profitability of the beef cattle industry over roughly a 10-year period. For this Market Intel, we are going to focus on the force behind cattle inventory, the breeding herd and calf crop.

The calf crop for 2021 came in at 35.1 million head, a 1.2% decrease from 2020. As of January 1, 2022, cow inventory totaled 30.1 million head, down 2.3% from 2021. Heifer inventory with total heifers at 19.8 million.

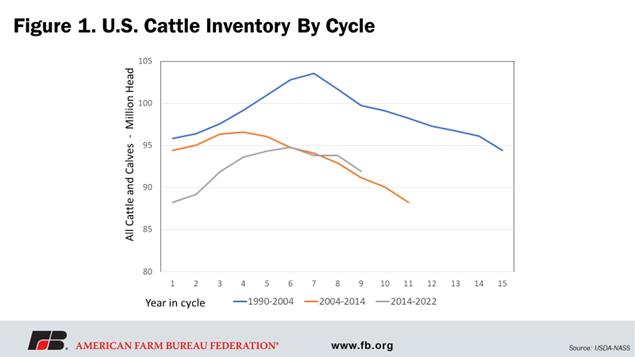

The last piece of this puzzle is supply and slaughter. Commercial cattle slaughter for April was 2.81 million head, down slightly from 2021. Steer slaughter was 1.33 million, 4% lower than 2021. Heifer slaughter for the month of April came in at 825,200, .05% lower than this time in 2021. Cow slaughter for the month of March came in at 640,382, 7% higher than the same time in 2021. It’s important to acknowledge the decrease in slaughter in all commercial cattle and the increase in cow and heifer slaughter. This illustrates industry position in the cattle cycle. Figure 1. illustrates the current and past two cattle cycles.

Based on Figure 1., the beef cattle industry is entering the contraction portion of the cattle cycle. Cows and heifers make up the breeding herd, which is responsible for supplying the calves entering the cattle inventory at any point during the cattle cycle. Increased cow and heifer slaughter will result in a smaller calf crop and inventory in the upcoming months of the cattle cycle. It is natural to conclude that future inventory will be down since the calf crop, cow and heifer inventory are all declining. However, the southern Plains are experiencing extreme drought and it is not uncommon to remove grazing animals from forage early for placement into feedlots under these circumstances. The movement of cattle from grazing to feedlot placement or vice versa can throw off inventory numbers.