According to the latest beef report released by Rabobank, global beef markets remain tight. Ongoing strong demand and more limited supplies have kept global beef prices high, but cost pressures are flowing into the supply chain.

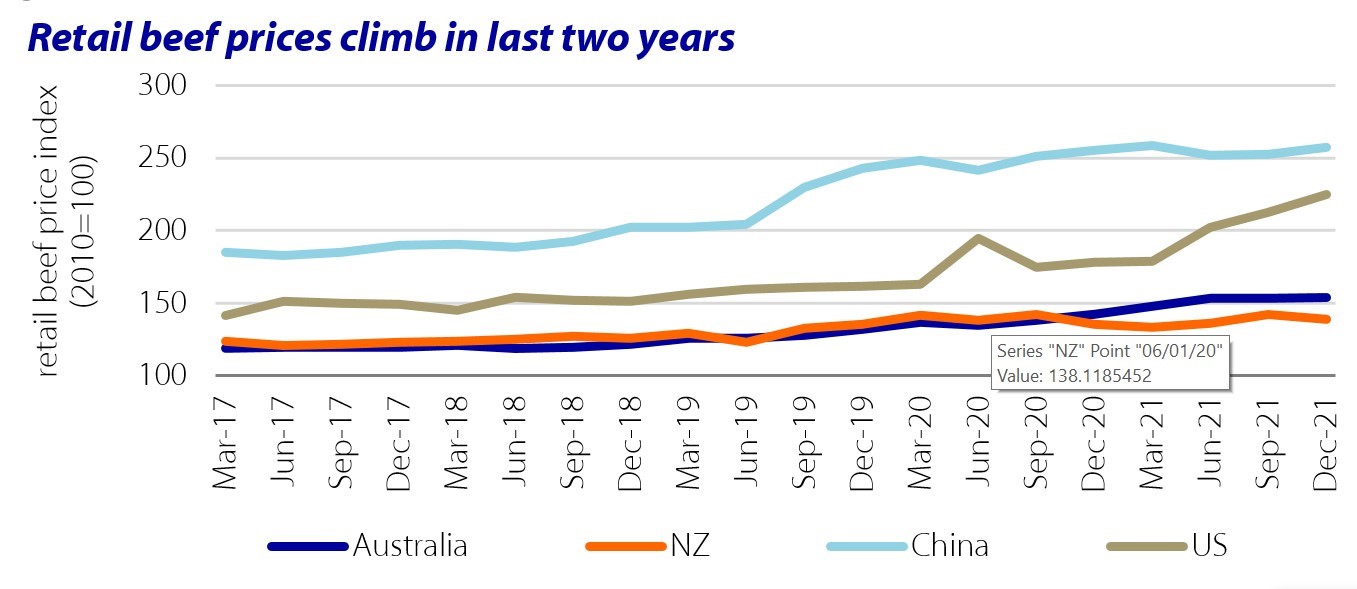

Rabobank said retail beef price movements over the past two years have been phenomenal, driven largely by strong consumer demand and some supply shocks. In fact, beef retail prices in the U.S. during Q4 2021 were 23% higher than the five-year average. In China, they were 24% above the five-year average.

“In many cases, this increase in prices was caused by demand pull. With supply unable to keep up, the increase in demand has created an imbalance in the market and as a result beef prices have lifted,” explained Angus Gidley-Baird, senior analyst of Animal Protein at Rabobank.

Supply chain costs continue to rise, will test consumers

The report shared that rising inflationary pressures continue to impact the beef supply chain. Among the cost increases, labor costs (and availability), freight, and energy are some of the largest, along with feed.

According to Gidley-Baird, a number of the cost increases – those associated with labor and sustainability, for example – will be permanent and will need to be accommodated within the supply chain. Others – such as freight, energy, and feed costs – are more cyclical and over time are expected to decline, allowing some easing of these costs through 2022.

In many cases, the rise in retail beef prices have seen some of the largest increases in history. Beef prices continued to increase through 2021, while many of the other proteins remained stable or contracted. “Further increases in beef prices run the risk of consumers substituting to other proteins or reducing their overall consumption. And we are starting to see signs that they might be reaching their limit,” said Gidley-Baird.

As all eyes are now on the Russian invasion of Ukraine, Gidley-Baird said no major impacts on global beef markets are expected from the tensions between the two countries.

With Russia having a less prominent role in global beef markets than five years ago, Rabobank does not expect big impacts on global beef markets. However, indirect impacts are possible, the firm suggested.

Rabobank’s January agri-commodity market report highlighted that Russia and Ukraine account for 29% of global wheat exports, so any trade embargoes could pressure feed prices. The feed complex is also under pressure from dry conditions in South America, with potential impacts on corn and soy production and prices.

Global beef production to rise

While the U.S. beef cattle herd continues to contract, other key beef producing countries are expected to increase production this year.

As it continues to recover from drought, Meat & Livestock Australia forecasts the country’s beef production in 2022 will rise by 12% to 2.08 million metric tons. By 2024, this is expected to reach 2.44 million metric tons, a 32% increase from 2021.

Brazil beef production is also forecast to, by rise 2%, during the first quarter of 2022. Despite low domestic demand, Rabobank said beef prices remain high. Additionally, Brazil had its largest month for both beef export value and volume in January after China resumed exports following the suspension of exports in Q4 2021 when two cases of BSE were discovered.

Production in the U.S. is a different story, although it is only expected to decline slightly. However, Rabobank is forecasting supplies will tighten even further in 2022.

“Drought conditions continue to be a huge pressure on the market,” the report noted. “Pasture conditions are limited, and hay availability is scarce and expensive.”

Currently, the U.S. cattle supply is extremely frontloaded as the drought is forcing cattle into the feedyards early, Rabobank said. A reduced supply of outside cattle should “aggressively” reduce fed cattle supplies in the second half of 2022, the firm added. Prices are already reflecting these changes.