Tom Brink - CEO, Red Angus Association of America

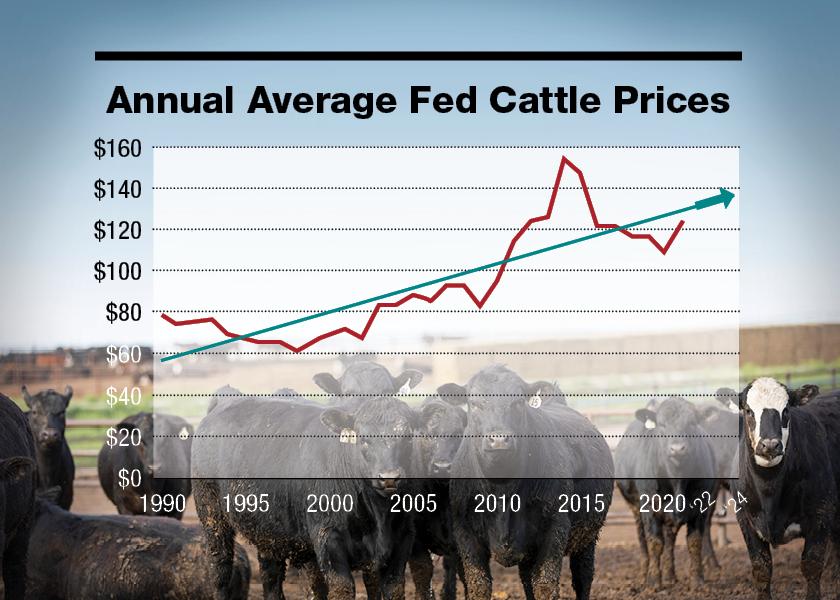

The recent jump in fed cattle prices to $140/cwt. is a harbinger for the future. Evaluating market fundamentals has led most analysts to project a stronger price trend over the next several years. But just how high could prices go? Answering that question with precision is not an easy task. However, if we study market patterns over the last 30 years, several valuable clues emerge.

The first major point is that fed cattle prices have been and remain in a long-term uptrend. Higher prices materialize due to inflation, nominal demand growth, new product development, larger exports and multiple other factors. It may not seem like it in the short run, but the natural direction of the market is higher, particularly over longer periods of time. Proof of that statement is found in the fact that fed cattle prices averaged $68/cwt. during the 1990s and only $91/cwt. in the first decade of the 2000s. The accompanying chart depicts this uptrend, though it is important to realize that long-term market patterns are often obscured by short-term volatility.

Point two is that cattle and beef supplies ebb and flow, which is one of the main reasons prices oscillate above and below the trendline. For example, in 2014 and 2015 when beef supplies were particularly tight, fed cattle sold $34 to $41 above the trendline. This aberration happened for a good reason: Cattle were scarce. That two-year time period produced the highest U.S. fed cattle prices on record, $154 and $149, respectively. Short-term supply/demand conditions caused the market to significantly over-perform its longer-term equilibrium as measured by the trendline.

Next, consider 2020 when the average fed price dipped $18 below the trendline. We can readily understand why this happened. COVID-19 disruptions decimated cattle demand as packing plants struggled to keep operating and restaurants closed their doors. As a result, cattle backed up in feedyards and weights shot up. It took until half way through 2021 to clean up many of these problems, which is why this year’s fed market also underperformed, though only by about $6. (last data point on the chart). With that said, it is important to recognize that the market rallied significantly above trendline during the final two months of 2021, providing a leading indicator for the direction the market is headed over the next few years.

Understanding What’s Ahead

Zoning in on 2022-2024 market fundamentals, most analysts are predicting smaller cattle numbers, continued strong beef demand, growing exports, increasing packing capacity and much better market leverage for feedyards. The fact that packer margins have been and remain large simply provides more upside price potential as the fundamentals become more positive and leverage shifts back to the seller. A good bet is that fed cattle prices outperform the trendline in 2022. After that, when additional packing capacity comes on line, the market could jump $25 to $35 above trend, maybe more. For the sake of discussion, if we use $30 over the trendline for 2023 and 2024, annual fed prices would set records at around $165 to $170 on average, and potentially spend a fair bit of time around $180 or higher.

A price increase of the magnitude predicted in the fed market would carry through to lighter-weight cattle, adding hundreds of dollars per head to the value of every calf and yearling. Of course, this won’t happen immediately. But if history coupled with expected market fundamentals mean anything, it should be a profit-enhancing ride upward for cattle producers over the next few years.