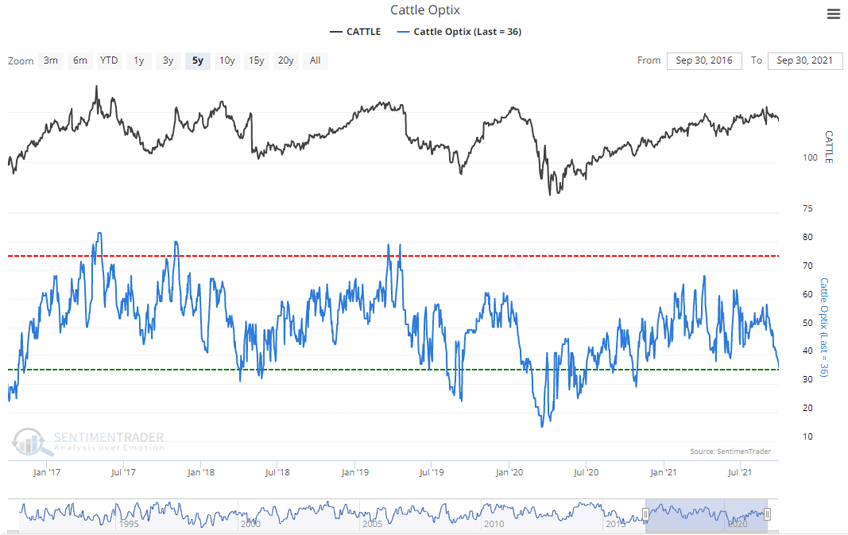

Cattle Bullish/Bearish Consensus...

SentimenTrader 5-Year Charts for the week ending October 1st

The theory behind the "Bullish/Bearish Consensus" indicator is when the public reaches a consensus, they are usually wrong:

-

They get too bullish after prices have risen and too bearish after they have already fallen. Because of this tendency, there are often extremes in opinion right before major changes in trend.

-

When the public reaches a bullish extreme, i.e., a great majority thinks prices will keep rising, then prices often decline instead. And when they become too bearish, then prices tend to rise.